Fillable Washington Resale Certificate Template

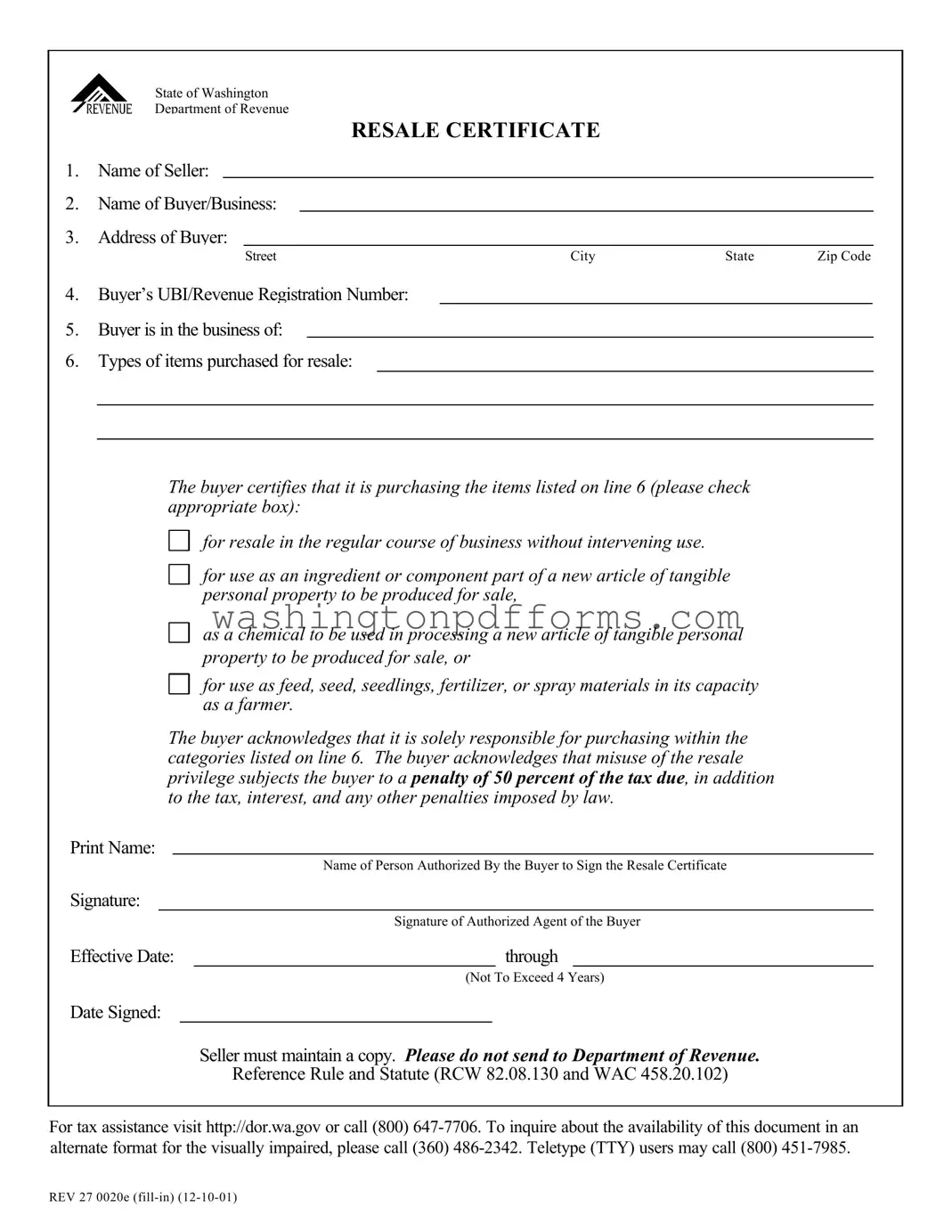

The Washington Resale Certificate form is a crucial document for businesses engaged in the sale of goods. It facilitates tax-exempt purchases for items intended for resale, thereby streamlining the buying process for retailers and wholesalers. This form requires essential information, including the names and addresses of both the seller and buyer, as well as the buyer's UBI or Revenue Registration Number. Additionally, it specifies the types of items that the buyer intends to purchase for resale. Buyers must certify that they are acquiring these items for resale in the regular course of business or for specific agricultural uses. Misuse of this resale privilege can lead to significant penalties, including a 50 percent tax penalty on top of the owed tax and interest. The form must be signed by an authorized representative of the buyer, and it is important to note that sellers are required to maintain a copy for their records. While this certificate is vital for tax compliance, it should not be submitted to the Department of Revenue. For further assistance, businesses can access resources online or contact the Department directly.

Common mistakes

Filling out the Washington Resale Certificate form is an important task for businesses, but it’s easy to make mistakes. One common error is failing to provide the correct name of the buyer or business. This information is crucial, as it identifies the entity that is purchasing items for resale. If the name is misspelled or incorrect, it can lead to complications down the line.

Another frequent mistake involves the address of the buyer. All sections of the address must be filled out completely, including the street, city, state, and zip code. Omitting any part of this information can result in delays or issues with tax compliance. It’s essential to double-check that every detail is accurate.

Many individuals overlook the UBI or Revenue Registration Number. This number is unique to each business and is necessary for proper identification. Without it, the resale certificate may be considered invalid. Buyers should ensure that they have this number readily available and that it is entered correctly on the form.

In line with this, another mistake often made is not clearly stating the type of items purchased for resale. This section should specify what the buyer intends to resell. Vague descriptions can lead to misunderstandings and potential tax penalties. Being specific about the items helps clarify the buyer's intent and ensures compliance with tax regulations.

Additionally, buyers sometimes forget to check the appropriate box regarding the use of the items. The form provides specific categories, and it’s crucial to select the right one. Misclassification can result in penalties, including a hefty 50 percent tax penalty for misuse of the resale privilege.

Another error involves the signature section. The form requires the signature of an authorized agent of the buyer. If this signature is missing or if the person signing is not authorized, the resale certificate may be deemed invalid. It’s important for businesses to ensure that the correct individual signs the document.

Lastly, not keeping a copy of the completed resale certificate can lead to issues later. Sellers are required to maintain a copy for their records, and buyers should also keep a copy for their own documentation. This practice helps protect both parties in case of an audit or any questions regarding the transaction.

Similar forms

The Washington Resale Certificate form is a crucial document used in transactions where goods are purchased for resale. Several other documents serve similar purposes in various contexts. Below are four documents that share similarities with the Washington Resale Certificate:

- California Resale Certificate: This form allows buyers in California to purchase goods without paying sales tax, provided the items are intended for resale. Like the Washington form, it requires the buyer's information, including their business name and seller's permit number, affirming the intent to resell the items.

- New York Resale Certificate: In New York, this certificate enables businesses to buy goods without sales tax for resale purposes. The form collects similar information, such as the buyer's name and business details, and certifies that the purchased items will not be used for personal consumption.

- Georgia ATV Bill of Sale: For those engaged in the sale or purchase of all-terrain vehicles, the comprehensive ATV Bill of Sale documentation is essential for ensuring proper ownership transfer.

- Texas Resale Certificate: This document serves the same purpose in Texas, allowing buyers to purchase items tax-free if they are for resale. The Texas form also requires the buyer to provide their business information and a declaration of the intended use of the purchased items.

- Florida Resale Certificate: In Florida, this certificate permits businesses to buy products without paying sales tax when those products are intended for resale. The form captures essential details about the buyer and the nature of the business, similar to the Washington Resale Certificate.

Each of these documents plays a vital role in ensuring compliance with state tax laws while facilitating smooth business transactions. They help businesses avoid unnecessary tax payments on items that will be resold, promoting a fair marketplace.

Other PDF Forms

Washington Liq 318 - Clear delineation between domestic and foreign shipments assists in accurate tax reporting.

A well-prepared Business Credit Application form is essential for any business seeking to establish trust with lenders, and it often includes detailed financial data and references. For those looking to streamline this process, resources such as smarttemplates.net can provide valuable tools that help ensure all required information is accurately captured, thereby enhancing the chances of securing necessary funding.

Joint Custody Washington State - Filling out the forms accurately is essential for them to be accepted by the court.