Fillable Washington Real Estate Excise Tax Affidavit Template

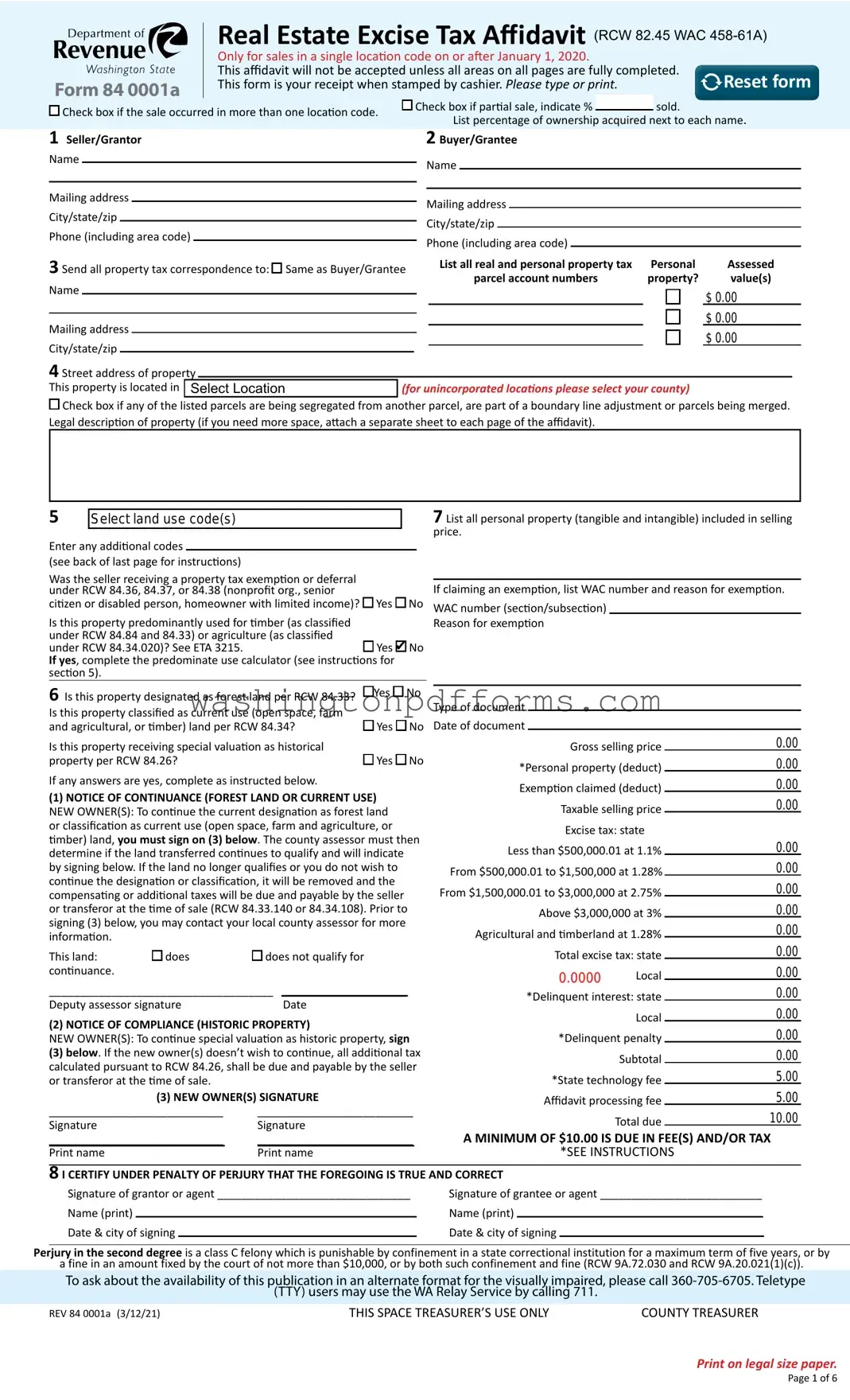

The Washington Real Estate Excise Tax Affidavit form plays a crucial role in the real estate transaction process within the state. This form is essential for reporting the sale of real property and calculating the excise tax owed to the state and local jurisdictions. When a property is sold, the seller must complete this affidavit to provide detailed information about the transaction, including the sale price, the parties involved, and any exemptions that may apply. Accurate completion of the form is vital, as it ensures compliance with state tax regulations and helps prevent potential legal issues down the line. Additionally, the affidavit must be filed with the county auditor's office at the time of recording the property transfer. By understanding the key components of this form, sellers and buyers can navigate the complexities of real estate transactions more effectively, ensuring that all tax obligations are met promptly and accurately.

Common mistakes

Filling out the Washington Real Estate Excise Tax Affidavit form can be straightforward, but many people still make common mistakes. One frequent error is neglecting to provide complete property information. This includes the parcel number, legal description, and address. Omitting any of these details can lead to delays or complications in processing.

Another common mistake is failing to accurately calculate the excise tax due. The tax is based on the sale price of the property, and miscalculating this amount can result in underpayment or overpayment. It is essential to double-check the figures to ensure they reflect the actual transaction.

Many individuals also forget to sign and date the affidavit. This simple oversight can render the form invalid. A signature is a confirmation that the information provided is true and accurate, and without it, the form may be rejected.

Inaccurate or incomplete buyer and seller information is another pitfall. Both parties must be clearly identified, including their full names and addresses. Missing this information can lead to confusion and potential legal issues later on.

Some filers neglect to include any applicable exemptions. Washington State offers certain exemptions from the excise tax, and failing to claim these can result in paying more tax than necessary. It's important to review eligibility for any exemptions before submitting the form.

Another mistake involves not using the correct form version. Tax forms can change, and using an outdated version may lead to complications. Always ensure you have the latest version of the affidavit to avoid unnecessary issues.

People sometimes overlook the need for supporting documentation. Certain transactions may require additional paperwork, such as proof of exemptions or other relevant documents. Failing to include these can cause delays in processing.

Misunderstanding the filing deadline is also a common error. The affidavit must be filed within a specific timeframe after the sale. Missing this deadline can result in penalties or additional fees.

Lastly, many individuals do not keep a copy of the submitted affidavit. Retaining a copy is important for personal records and can be useful if any questions arise in the future. Keeping organized records helps ensure a smoother process in any real estate transaction.

Similar forms

Property Transfer Declaration: This document is used to declare the transfer of property ownership. Like the Excise Tax Affidavit, it provides essential information about the transaction and the parties involved.

Quit Claim Deed: A Quit Claim Deed transfers ownership without guaranteeing the title. Similar to the Excise Tax Affidavit, it requires the disclosure of the parties and the property involved.

Warranty Deed: This deed guarantees that the seller holds clear title to the property. It shares similarities with the Excise Tax Affidavit in that both documents involve the transfer of real estate and require detailed information about the transaction.

Real Estate Purchase Agreement: This contract outlines the terms of a property sale. Like the Excise Tax Affidavit, it includes critical details about the parties and the property, ensuring transparency in the transaction.

Title Insurance Policy: This document protects against losses from defects in the title. It is similar to the Excise Tax Affidavit in that both focus on the legitimacy of the property transfer and the parties' rights.

Closing Disclosure: This document provides a detailed account of the final terms of the mortgage and closing costs. Like the Excise Tax Affidavit, it ensures that all parties are informed about the financial aspects of the transaction.

Affidavit of Value: This document states the value of the property being transferred. It is similar to the Excise Tax Affidavit as both require an assessment of the property's worth in relation to the transaction.

BBB Complaint Form: This form allows consumers to formally address grievances about businesses, much like the documents that aid in real estate transactions. For more details, visit TopTemplates.info.

Transfer Tax Return: This form is filed to report the transfer of real estate and calculate any applicable taxes. Like the Excise Tax Affidavit, it is essential for compliance with tax regulations related to property transactions.

Deed of Trust: This document secures a loan with real estate. It shares similarities with the Excise Tax Affidavit in that both involve the transfer of interest in property and require specific information about the parties involved.

Statement of Information: This document provides background information about the parties involved in a real estate transaction. Like the Excise Tax Affidavit, it helps ensure that all relevant details are available for a smooth transfer process.

Other PDF Forms

New Hire Paperwork Washington State - Applications will be reviewed in the context of specific job openings.

This form is an integral component of the rental process, ensuring both parties understand their obligations with the clearly defined California Room Rental Agreement terms. For a seamless renting experience, consider our user-friendly Room Rental Agreement preparation.

Kinder Wellness - The documentation provided through this form helps ensure community immunity.