Fillable Washington Liq 318 Template

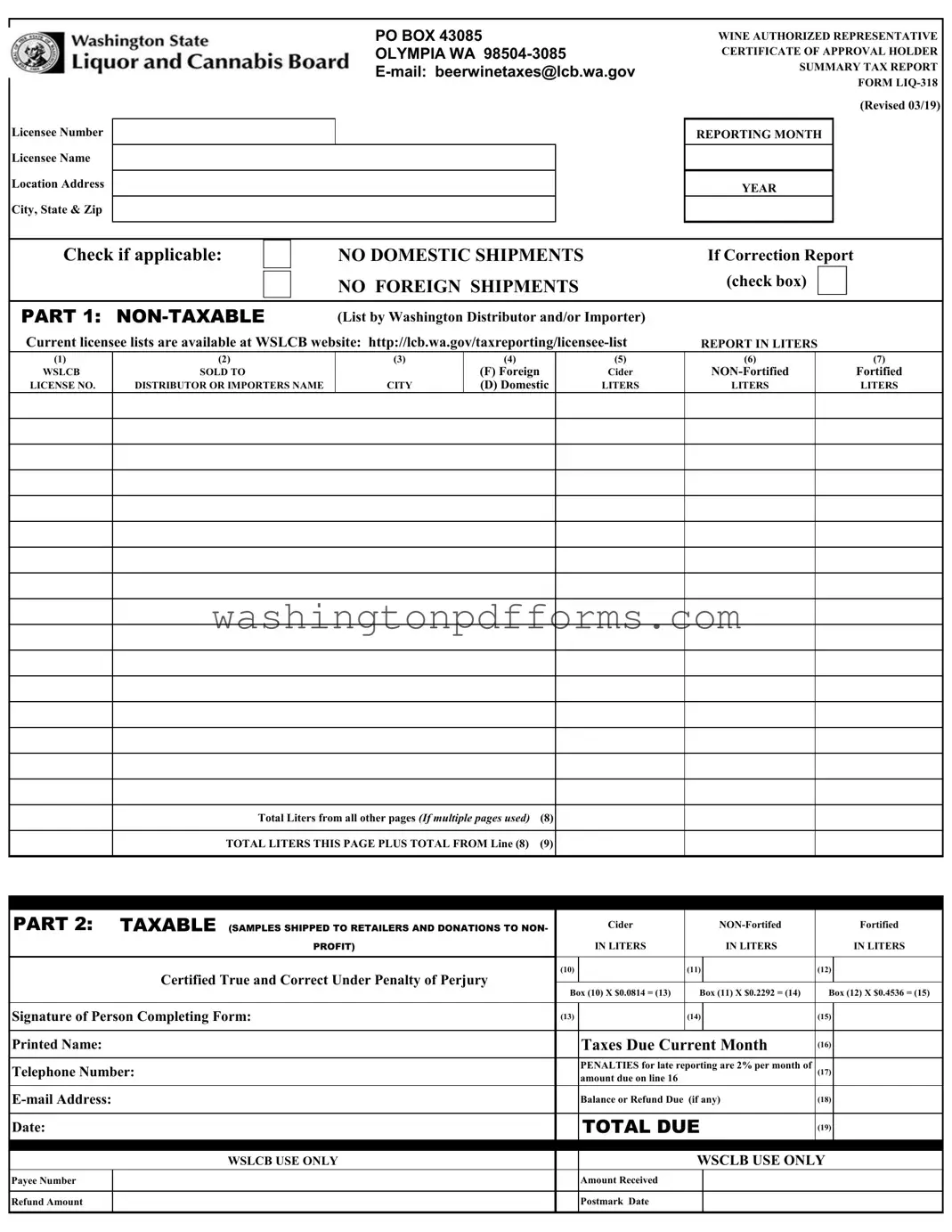

The Washington Liq 318 form is an essential document for wine distributors and importers operating in the state. This form, known as the Wine Authorized Representative Certificate of Approval Holder Summary Tax Report, must be completed monthly by all holders of the certificate. It requires detailed reporting of both taxable and non-taxable shipments of wine, including cider and fortified wines. Licensees must provide their unique license number, name, and address, along with specific details about shipments made during the reporting month. The form also includes sections for reporting liters shipped to various distributors or importers and calculating taxes due based on the volume of wine shipped. Timely submission is crucial, as reports must be postmarked by the 20th of the month following the reporting period. Failure to file on time can result in penalties, which accumulate at a rate of 2% per month on the amount due. Even in months with no activity, a report must still be submitted, ensuring that all licensees maintain compliance with state regulations. Understanding the requirements and properly completing the Liq 318 form is vital for any business involved in the wine industry in Washington State.

Common mistakes

Filling out the Washington Liq 318 form can be straightforward, but several common mistakes can lead to complications. One frequent error is failing to enter the correct licensee number. This six-digit number is crucial for identifying your business. Double-check this information to ensure accuracy.

Another common mistake is not reporting all shipments for the month. Even if there were no sales, a report must still be submitted. Mark the appropriate box for no shipments if applicable. Omitting this can result in penalties and delays in processing.

Many individuals also neglect to include the correct location address as per their license. This can lead to confusion and miscommunication. Ensure that the address matches what is registered with the Washington State Liquor and Cannabis Board (WSLCB).

When reporting shipments, it’s essential to differentiate between domestic and foreign products. Failing to do so can lead to inaccurate tax calculations. Use the designated letters 'D' for domestic and 'F' for foreign to avoid this mistake.

Additionally, individuals often miscalculate the total liters shipped. Ensure that the figures in each category are accurate and that totals are correctly summed. This includes checking the calculations for taxable shipments in Part 2, which can be easily overlooked.

Another frequent oversight is not signing the form. The signature of the person completing the form is mandatory. Without it, the report may be considered incomplete and may not be processed.

Make sure to include a valid telephone number and email address. This information is vital for communication regarding your report. Missing contact details can lead to delays or issues in processing.

Lastly, be aware of the deadlines. Reports must be postmarked by the 20th of the following month. If the 20th falls on a weekend or holiday, submit your report by the next business day. Late submissions incur penalties, which can accumulate quickly.

Similar forms

The Washington Liq 318 form is essential for reporting wine shipments and taxes. Several other documents serve similar purposes in the realm of alcohol distribution and taxation. Here are five documents that share similarities with the Washington Liq 318 form:

- Form LIQ-778: This form is used for reporting direct shipments of wine to consumers or retailers. Like the Liq 318, it requires detailed information about the shipments, but it specifically addresses direct sales rather than distributor transactions.

California DMV DL 44 Form: This form is integral for those applying or renewing their California driver's license or ID, similar to how the LIQ-318 is vital for liquor license reporting. For more information, visit smarttemplates.net/.

- Form LIQ-320: This form is for reporting beer shipments and taxes. It parallels the Liq 318 in structure and purpose, focusing on the monthly reporting of taxable and non-taxable shipments, but is tailored specifically for beer rather than wine.

- Form LIQ-400: This document is a license renewal application for wine distributors. While it does not report shipments, it shares the same regulatory framework and requires similar information about the business and its operations.

- Form LIQ-312: This form is a monthly tax report for spirits. Similar to the Liq 318, it involves reporting the quantity of spirits shipped and calculating taxes owed, ensuring compliance with state regulations.

- Form LIQ-340: This is a report for special events involving alcohol sales. It requires details about the event and the types of alcohol sold, much like the Liq 318, which details wine shipments and taxes, although it focuses on temporary sales rather than ongoing distribution.

Other PDF Forms

Wa 237 - The form serves a clear purpose in facilitating the business of warehouse receipt management.

To further assist individuals in navigating the claims process, resources are available online, such as those found at OnlineLawDocs.com, which provide detailed guidance on the Asurion F-017-08 MEN form and its requirements.

Ewu Unofficial Transcript - Verify that the recipient's email address is correct to ensure successful electronic delivery.

Job Search Activities - This form is a critical component of your unemployment benefits process.