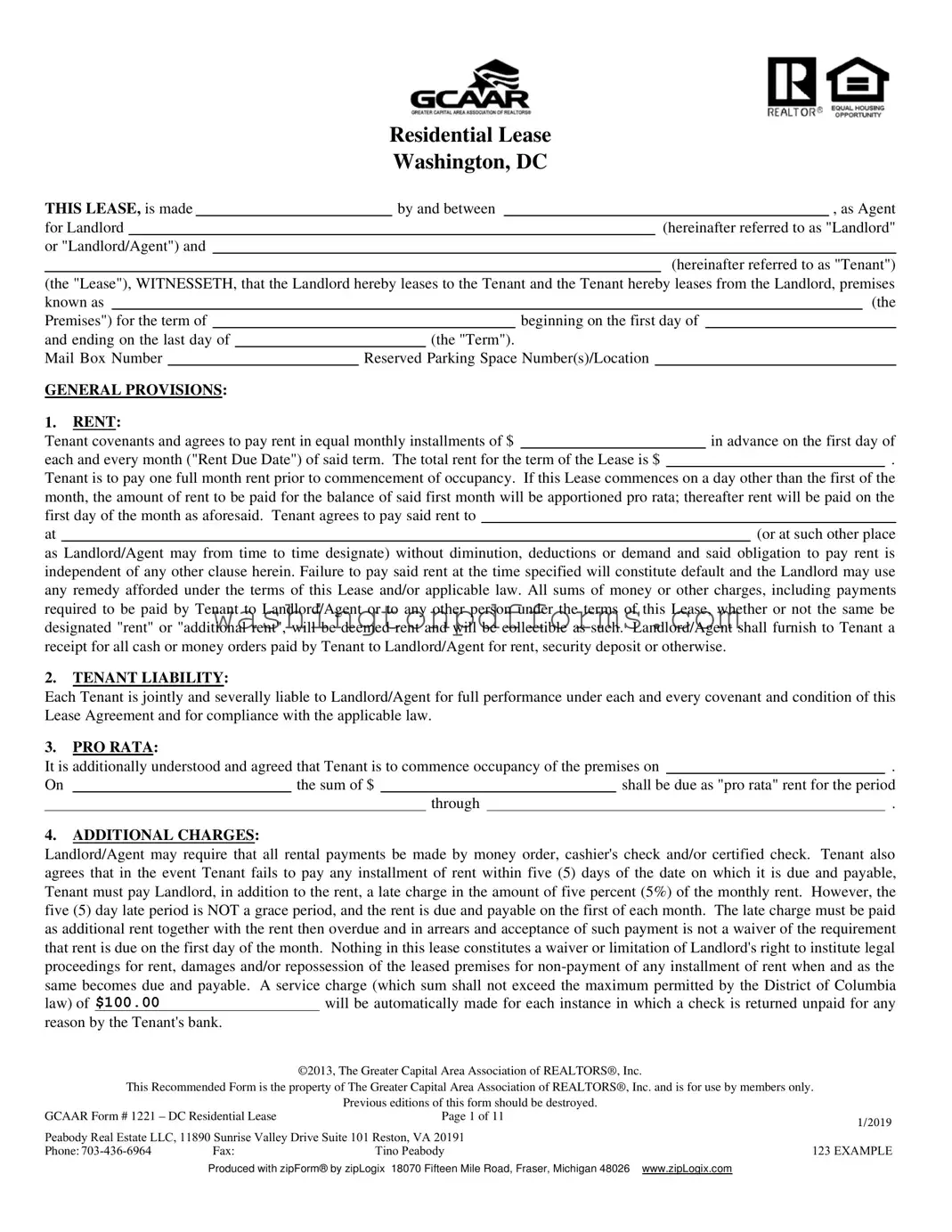

Fillable Washington Dc Residential Lease Agreement Template

The Washington, D.C. Residential Lease Agreement form serves as a vital document for landlords and tenants entering into a rental agreement. This form outlines the responsibilities and rights of both parties, ensuring a clear understanding of the lease terms. Key elements include the rental amount, payment schedule, and the importance of timely rent payments. Tenants are required to pay rent in advance, with specific provisions for prorated rent if the lease begins mid-month. Additionally, the form addresses security deposits, detailing how they are to be handled and returned, as well as the conditions under which deductions may be made. It emphasizes the joint liability of tenants for fulfilling lease obligations and outlines potential late fees for overdue payments. The agreement also covers possession of the premises, ensuring that tenants are not held responsible for rent if the landlord cannot provide access at the start of the lease. Overall, this form aims to protect both parties while facilitating a smooth rental experience.

Common mistakes

Filling out the Washington DC Residential Lease Agreement form can be a straightforward process, but there are common mistakes that individuals often make. One frequent error is leaving out important personal information. When identifying the parties involved, both the Landlord and Tenant must provide complete names and contact details. Omitting this information can lead to confusion or disputes later on.

Another common mistake is failing to specify the rental amount clearly. The agreement should state the exact monthly rent and any additional fees. If this section is incomplete or unclear, it can create misunderstandings about payment obligations. Additionally, tenants should be careful to note the due date for rent payments. Missing this detail can lead to late fees or even eviction notices.

Many people overlook the importance of the security deposit section. It is crucial to specify the amount of the security deposit and understand how it will be handled. This includes knowing that the deposit cannot be used to cover rent and must be returned within the stipulated time frame after the lease ends. Not paying attention to these details can result in financial loss.

Another mistake involves the pro rata rent calculation. If the lease starts on a day other than the first of the month, tenants must ensure they understand how much rent is owed for that initial period. Failing to calculate this correctly can lead to either underpayment or overpayment, both of which can complicate the rental relationship.

Additionally, tenants often neglect to review the late payment clause. Understanding the implications of late fees is essential. If rent is not paid on time, a late fee may be incurred. This fee is not a grace period; it is an additional charge that must be paid alongside the overdue rent.

Another frequent oversight is not reading the terms regarding possession. If the Landlord cannot provide possession of the property at the start of the lease, tenants should know their rights regarding rent payments during that period. Misunderstanding this clause can lead to unexpected financial obligations.

Moreover, tenants sometimes fail to acknowledge the implications of joint liability. If there are multiple tenants, each one is jointly responsible for the lease terms. This means that if one tenant fails to pay rent, the others may be held accountable. Understanding this shared responsibility is crucial to avoid disputes among roommates.

Finally, many individuals forget to ask questions or seek clarification on any unclear terms. It is vital to fully understand the lease agreement before signing. Taking the time to address any uncertainties can prevent issues down the line and ensure a smoother rental experience.

Similar forms

-

Commercial Lease Agreement: Similar to a residential lease, a commercial lease outlines the terms under which a business can occupy a commercial property. Both documents specify the duration of the lease, payment terms, and responsibilities of the tenant and landlord, though commercial leases often include additional clauses related to business operations.

- Tax Return Transcript: The https://topformsonline.com/sample-tax-return-transcript is essential for understanding your tax obligations as it provides a detailed overview of your filed income, credits, and adjustments, ensuring accuracy in future financial dealings.

-

Sublease Agreement: This document allows a tenant to lease the property to another individual. Like the residential lease, it includes terms about rent, duration, and responsibilities, but it also requires the original tenant to remain liable for the lease terms with the landlord.

-

Roommate Agreement: When multiple tenants share a rental property, a roommate agreement can clarify each person's rights and responsibilities. Similar to a residential lease, it addresses rent payments, utility responsibilities, and rules for shared spaces.

-

Lease Renewal Agreement: This document extends the terms of an existing lease. It shares similarities with the original residential lease by reiterating key terms such as rent amount and duration, but it may also include updates based on the current rental market.

-

Rental Application: While not a lease itself, a rental application precedes the lease agreement. It collects information from potential tenants, similar to how a residential lease outlines the obligations of the tenant once selected.

-

Eviction Notice: This document outlines the reasons for terminating a lease and the process for eviction. It parallels the residential lease in that it references the terms agreed upon and the consequences of failing to comply with those terms.

-

Property Management Agreement: This document is between a property owner and a management company. It details responsibilities for managing rental properties, akin to how a residential lease defines the relationship between landlord and tenant.

-

Lease Assignment Agreement: This allows a tenant to transfer their lease obligations to another party. Similar to the residential lease, it outlines the terms of occupancy, but it also emphasizes the responsibilities of the new tenant and the original tenant's ongoing obligations.

Other PDF Forms

Vehicle Bill of Sale Wa - Providing complete information enhances the effectiveness of public aid programs.

For those looking to take action against unfair business practices, using the BBB Complaint Form is an important step. This form allows consumers to formally express their grievances and seek resolution with businesses. To further assist in understanding the complaint process, you can visit OnlineLawDocs.com for additional resources and guidance.

The Pac Program - Creating a safe space for consumers to discuss sensitive issues can enhance the accuracy of substance use assessments.

The Art Institute of San Antonio - Maintain a professional tone when addressing the recipient on your request.