Fillable Washington Af 595 Template

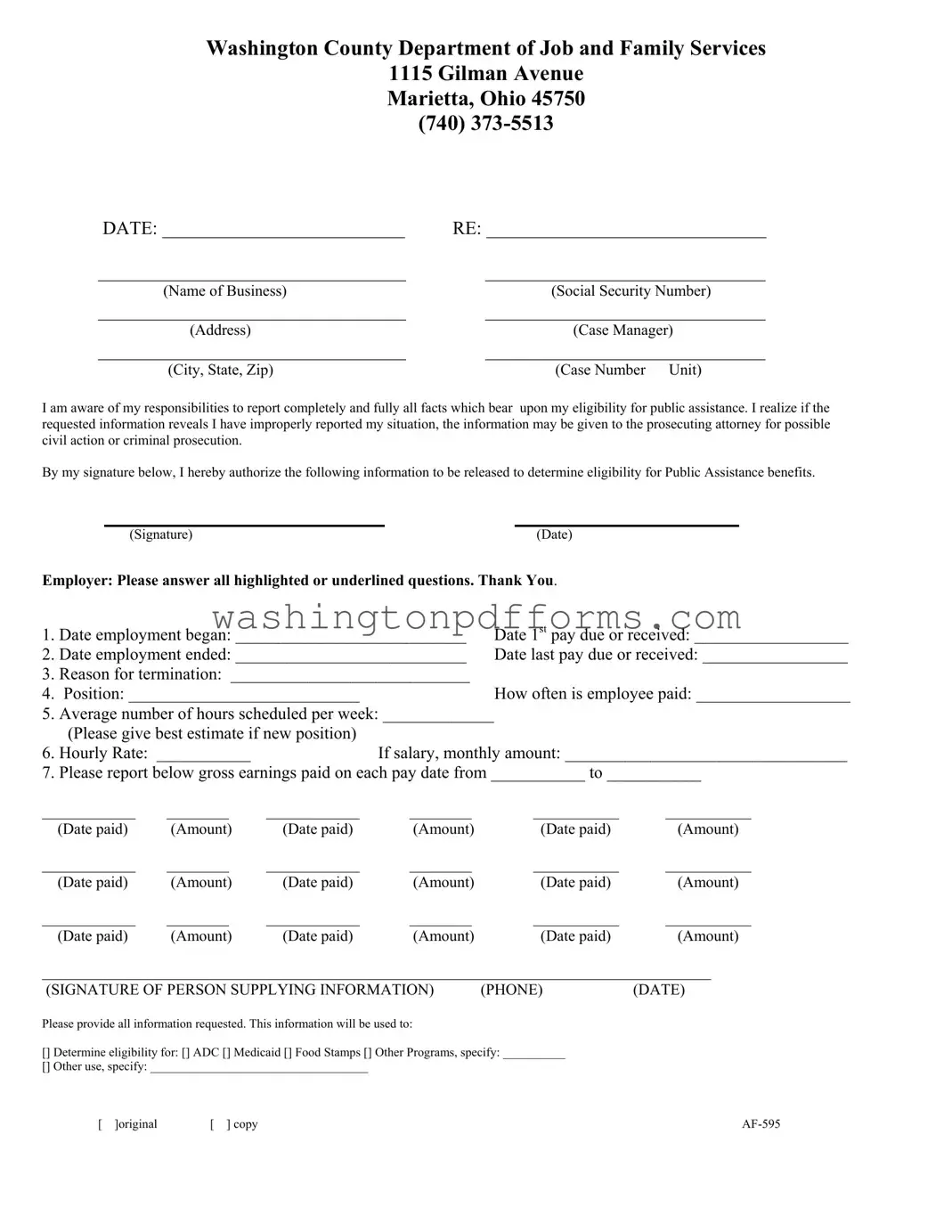

The Washington Af 595 form plays a crucial role in determining eligibility for public assistance programs in Washington County, Ohio. This form collects essential information from both the applicant and their employer to ensure a thorough evaluation of financial circumstances. It asks for details such as the applicant's employment dates, position, and earnings, along with the reason for any job termination. The form emphasizes the importance of providing accurate and complete information, as discrepancies could lead to serious legal consequences. By signing the form, individuals authorize the release of their employment details, which will be used to assess eligibility for various assistance programs, including ADC, Medicaid, and food stamps. The form is designed to facilitate a clear understanding of an applicant's situation, ensuring that those in need receive the support they deserve while maintaining the integrity of the assistance programs.

Common mistakes

When filling out the Washington AF 595 form, individuals often make critical mistakes that can lead to delays or complications in their public assistance applications. One common error is failing to provide complete and accurate personal information. This includes not filling in the name of the business, Social Security number, or address correctly. Incomplete information can result in processing delays or even denial of benefits.

Another frequent mistake involves not reporting employment dates accurately. Applicants may misstate the date employment began or ended, which can lead to discrepancies in eligibility assessments. It's essential to provide precise dates, as this information directly impacts the calculation of benefits.

Many individuals also overlook the importance of detailing the reason for termination. This section is crucial for case managers to understand the applicant's situation fully. A vague or missing explanation can raise red flags, prompting further scrutiny of the application.

Additionally, failing to report gross earnings correctly is a significant error. Applicants must list all pay dates and amounts accurately. Inconsistencies in reported earnings can lead to investigations and potential legal consequences, including criminal prosecution for misrepresentation.

Lastly, some applicants neglect to sign and date the form. A missing signature can render the application invalid, causing unnecessary delays. It is vital to ensure that all required sections are completed, including the signature of the person supplying information, to facilitate a smooth review process.

Similar forms

- Form W-2: Similar to the Washington AF 595 form, the W-2 form reports an employee's annual wages and the taxes withheld. Both documents require detailed employment information to assess eligibility for various benefits.

- Form 1099: This form is used to report income received by independent contractors and freelancers. Like the AF 595, it provides a breakdown of earnings that may influence public assistance eligibility.

- Employment Verification Letter: This document is issued by an employer to confirm an employee's job status and salary. It shares the purpose of providing necessary employment details for determining eligibility for assistance programs.

- Pay Stubs: Pay stubs detail an employee's earnings over a specific period. They serve a similar function to the AF 595 by providing proof of income necessary for evaluating public assistance eligibility.

- Unemployment Benefits Application: This application collects information about an individual's employment history and income. It parallels the AF 595 in its objective of assessing financial need for government assistance.

- Social Security Administration (SSA) Work History Report: This report outlines an individual's work history and earnings, similar to the AF 595. It helps determine eligibility for Social Security benefits and other assistance programs.

Other PDF Forms

Stop Work Form Dshs - Civil rights protections safeguard applicants from discrimination in the assistance process.

Reseller's Permit - The resale certificate is a straightforward tool for managing business expenses.