Fillable Washington 5 Template

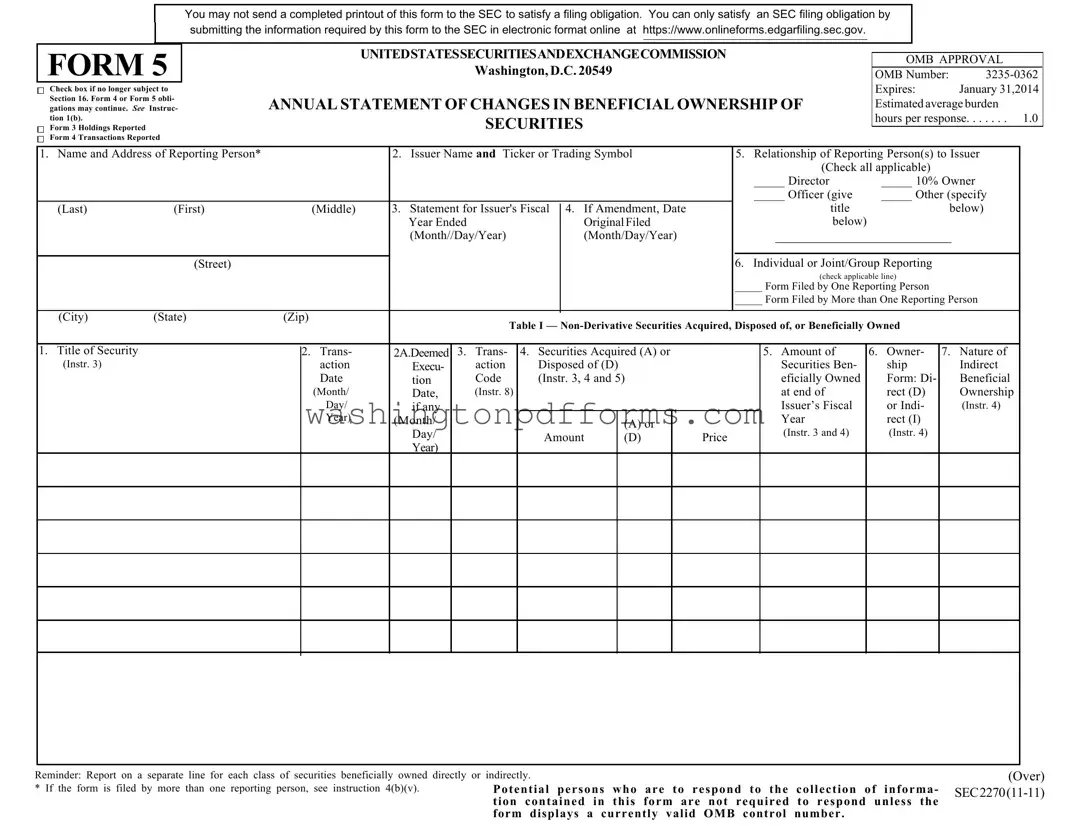

The Washington 5 form is a crucial document for individuals involved in the ownership of securities, particularly those who are subject to the rules of the Securities and Exchange Commission (SEC). This form serves as an annual statement of changes in beneficial ownership of securities, providing transparency and accountability in the financial markets. It requires reporting persons to disclose their relationship with the issuer, the fiscal year end date, and detailed information about their securities transactions. Notably, the Washington 5 form includes sections for both non-derivative and derivative securities, ensuring that all types of ownership changes are accurately reported. Individuals must be aware that submitting this form in paper format to the SEC does not fulfill their filing obligations; instead, electronic submission is required through the SEC’s online platform. Additionally, the form allows for the indication of whether the reporting person is no longer subject to Section 16 obligations, which can have significant implications for compliance. Understanding how to complete and file the Washington 5 form is essential for maintaining regulatory adherence and protecting the integrity of the securities market.

Common mistakes

When completing the Washington 5 form, individuals often encounter several common mistakes that can lead to complications or delays in processing. Understanding these pitfalls can help ensure a smoother filing experience.

One frequent error is failing to include the correct name and address of the reporting person. This section is critical, as it identifies who is filing the form. Any inaccuracies can result in confusion or miscommunication with the SEC.

Another mistake involves neglecting to specify the issuer name and ticker symbol. This information is essential for the SEC to understand which company's securities are being reported. Omitting this detail can lead to the form being rejected or returned for correction.

Many filers also overlook the requirement to check the appropriate box for the relationship of the reporting person to the issuer. This section must accurately reflect the individual's role, whether as a director, officer, or other specified relationship. Incorrect selections can misrepresent the reporting person's position and obligations.

Inaccuracies in the transaction dates are another common issue. Filers must ensure that the dates provided are correct and correspond to the fiscal year being reported. Mistakes in this area can complicate compliance and lead to potential penalties.

Some individuals fail to report all required securities transactions. Each class of securities must be listed on a separate line, and all acquisitions or dispositions should be documented. Missing transactions can lead to incomplete filings, which may result in enforcement actions.

Additionally, filers sometimes neglect to indicate whether the form is being filed by one or more reporting persons. This distinction is important for clarity, especially in joint filings. Misunderstanding this requirement can create confusion regarding who is responsible for the information provided.

Another mistake occurs when individuals do not properly complete the section regarding derivative securities. This includes failing to provide details about the transaction type, conversion price, or expiration dates. Incomplete information can hinder the SEC's ability to process the filing effectively.

Lastly, many people overlook the necessity of a manual signature on the form. Even if the filing is submitted electronically, a signed copy must be included. Failing to provide a signature can lead to the form being deemed invalid.

By being aware of these common mistakes, individuals can improve their accuracy and compliance when completing the Washington 5 form. Proper attention to detail can prevent delays and ensure that all required information is accurately reported.

Similar forms

The Washington 5 form serves a specific purpose in the realm of securities reporting, particularly for changes in beneficial ownership. Several other documents share similarities with this form, often used for reporting and compliance in the financial sector. Here’s a look at nine such documents:

- Form 3: This form is used to report initial ownership of securities by insiders. Like the Washington 5, it requires details about the reporting person and the securities involved, establishing a baseline for future reports.

- Form 4: This document is utilized to report transactions involving securities by insiders. Similar to the Washington 5, it captures changes in ownership but focuses specifically on transactions that occur during the reporting period.

-

California RE 205: The California Re 205 form is essential for individuals applying for real estate licenses, confirming compliance with citizenship or immigration status requirements.

- Form 13D: This form is filed by individuals or groups who acquire more than 5% of a company's equity securities. It parallels the Washington 5 in that it requires disclosure of ownership interests, but it is more comprehensive regarding the purpose of the acquisition.

- Form 13G: This is a shorter version of Form 13D, intended for passive investors. Both forms require similar ownership disclosures, but Form 13G is less detailed regarding the intent behind the acquisition.

- Form 10-K: This annual report provides a comprehensive overview of a company’s financial performance. While it serves a broader purpose than the Washington 5, both documents require accurate reporting of ownership and financial information.

- Form 10-Q: Similar to the Form 10-K, this quarterly report gives updates on a company's financial status. Both forms are essential for transparency and include information on stock ownership and changes.

- Form S-1: This registration statement is used for new securities offerings. It shares similarities with the Washington 5 in that it includes information about the issuer and its securities, although it focuses on new offerings rather than changes in ownership.

- Form S-3: This is a simplified registration form for certain eligible companies. Like the Washington 5, it aims to provide essential information about securities, but it is typically used for follow-on offerings.

- Form 8-K: This report is used to disclose significant events that shareholders should know about. Both the Form 8-K and Washington 5 are crucial for keeping investors informed, although they cover different types of disclosures.

Understanding these forms can help individuals navigate the complex landscape of securities reporting and compliance, ensuring that they meet their obligations effectively.

Other PDF Forms

Washington Liq 318 - Not reporting any shipment activity requires checking specific boxes on the form.

For a smooth transaction, ensure you understand the importance of the ATV Bill of Sale documentation. To learn more about how this form can benefit your purchase or sale, visit our guide on the necessary ATV Bill of Sale requirements.

Washington Liq 365 - Applicants need to provide their date of birth on the form.