Fillable Washington 27 0054 Template

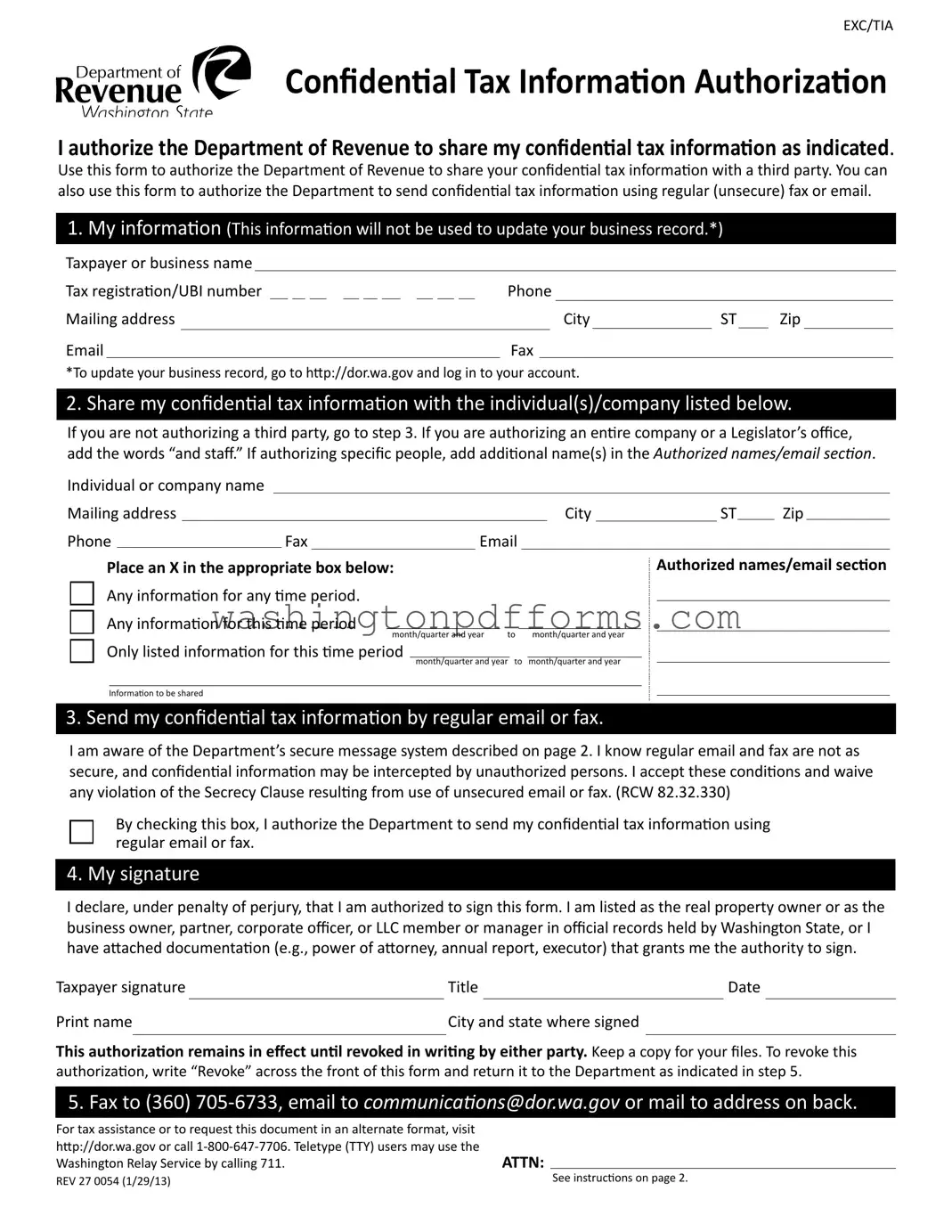

The Washington 27 0054 form, also known as the Confidential Tax Information Authorization, serves a crucial purpose for taxpayers in the state. This form allows individuals and businesses to authorize the Washington Department of Revenue to share their confidential tax information with designated third parties. Whether you need to provide information to a tax advisor, accountant, or another authorized individual, this form simplifies the process. It includes sections for your personal information, details about the third party you wish to authorize, and the specific information you want to share. Additionally, it offers the option to send this information via regular email or fax, though it’s important to note that these methods are less secure than the Department's secure messaging system. By completing the form, you acknowledge the risks associated with using unsecured communication channels. The authorization remains effective until revoked in writing, ensuring that you maintain control over who can access your sensitive tax details. Understanding how to properly fill out and submit this form can help you navigate your tax obligations with ease and confidence.

Common mistakes

Filling out the Washington 27 0054 form can be a straightforward process, but many individuals make common mistakes that can lead to delays or complications. One prevalent error is providing incorrect or incomplete taxpayer information. This includes the business name, tax registration number, or mailing address. If any of these details are inaccurate, it can hinder the Department of Revenue from processing the request effectively.

Another frequent mistake involves misunderstanding the authorization section. Some people fail to specify the individual or company to whom they are granting access to their confidential tax information. It is crucial to clearly list the names or companies, as vague entries can lead to confusion. Additionally, forgetting to add “and staff” when authorizing an entire company or legislative office can result in limited access for those who may need it.

In section 2, individuals often neglect to indicate the specific information they wish to share. This oversight can create unnecessary complications, as the Department may not know whether to provide all information or only details pertaining to a specific time period. Clarity in this section is essential to ensure that the correct data is shared.

Moreover, many applicants overlook the implications of using regular email or fax for transmitting sensitive information. While the form does require acknowledgment of the risks associated with unsecured communication, some individuals fail to check the appropriate box, thereby not formally consenting to this method of information sharing. This can lead to misunderstandings about the security of their data.

Another common pitfall is related to the signature section. Individuals sometimes forget to sign the form or fail to provide their title and date. Without a signature, the Department cannot process the authorization, rendering the entire form ineffective. It is also important to ensure that the signatory is indeed authorized to make such requests, as any discrepancies can lead to legal complications.

Many people also fail to keep a copy of the submitted form for their records. This step is crucial, as having a copy can be beneficial for future reference or if any issues arise regarding the authorization. Not retaining a copy can complicate matters if the Department needs to verify the authorization later.

Lastly, individuals sometimes do not follow the submission instructions correctly. Whether it is faxing, emailing, or mailing the form, each method has specific guidelines that must be adhered to. Failure to follow these instructions can result in the form being lost or not processed in a timely manner.

By being mindful of these common mistakes, individuals can ensure a smoother experience when filling out the Washington 27 0054 form. Attention to detail and a clear understanding of the requirements can help facilitate the sharing of confidential tax information without unnecessary delays.

Similar forms

- IRS Form 4506-T - This form allows taxpayers to request a transcript of their tax return. Like the Washington 27 0054, it authorizes the IRS to share confidential tax information with third parties.

- IRS Form 8821 - This document is used to authorize the IRS to disclose tax information to a designated individual or organization. Similar to the Washington form, it provides a way to share sensitive information.

- California Form FTB 3520 - This form allows taxpayers to authorize another person to receive confidential tax information from the California Franchise Tax Board. It serves a similar purpose of information sharing.

- New York Form TR-579 - This form allows taxpayers to authorize the release of their tax information to a third party. It mirrors the authorization process found in the Washington form.

- Texas Form 05-102 - This document is used to authorize the Texas Comptroller to disclose tax information to a specified person or entity, similar to the Washington authorization process.

- Florida Form DR-835 - This form allows taxpayers to authorize the Florida Department of Revenue to share tax information with a third party. It functions similarly to the Washington 27 0054.

- California DMV DL 44 Form - Essential for applying, renewing, or changing your driver's license or ID in California, this form requires complete and accurate personal and licensing information. For further assistance, visit https://smarttemplates.net/.

- Illinois Form IL-2848 - This is a Power of Attorney form for the Illinois Department of Revenue. It allows for the sharing of tax information, much like the Washington form.

- Virginia Form ST-8 - This form is used to authorize the Virginia Department of Taxation to disclose tax information to a designated representative, similar to the Washington form's purpose.

- Ohio Form IT 1040 - This form allows taxpayers to authorize the Ohio Department of Taxation to share tax information with a third party. It serves the same function as the Washington 27 0054.

- Michigan Form 151 - This form allows for the authorization of tax information disclosure to a third party by the Michigan Department of Treasury. It aligns with the purpose of the Washington form.

Other PDF Forms

New Hire Paperwork Washington State - This form helps streamline the application process for various employers.

Washington Vehicle Bill of Sale - If more space is needed, follow specific instructions outlined in the form.

In order to begin the process of becoming an authorized lottery retailer in Florida, business owners must complete the Florida Lottery DOL-129 form, which requires careful attention to detail and submission alongside a non-refundable application fee. This form plays a crucial role in acquiring a Florida Lottery ID while also facilitating necessary background checks on applicants to ensure compliance with state regulations. Additionally, it collects essential business information and the personal details of all owners and key stakeholders, reinforcing the Florida Lottery's dedication to upholding integrity and security. For those seeking a convenient way to access this form, a pdf download is available to streamline the process.

Job Search Activities - Keep your logs organized and accessible in case you need to showcase your job search efforts.