Attorney-Approved Washington Transfer-on-Death Deed Template

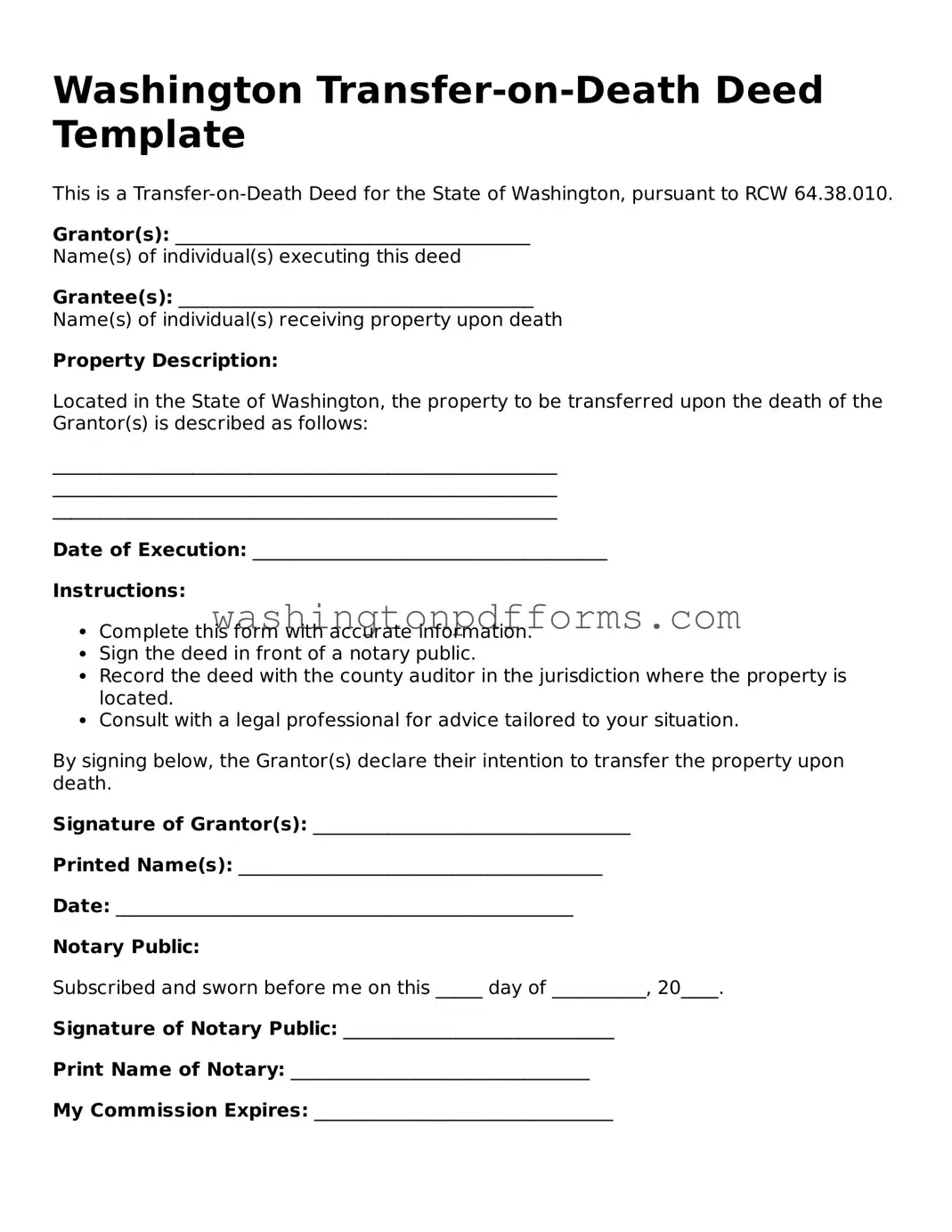

The Washington Transfer-on-Death Deed form serves as a valuable estate planning tool, allowing property owners to transfer real estate to their chosen beneficiaries without the need for probate. This deed enables individuals to retain full control of their property during their lifetime, while ensuring a smooth transition of ownership upon their passing. By completing this form, property owners can specify who will receive their real estate, making it a straightforward way to convey assets to heirs. The process is designed to be simple, requiring the form to be signed, notarized, and recorded with the county auditor. Importantly, this deed does not affect the owner's rights to sell, mortgage, or otherwise manage the property while they are alive. Additionally, it provides a level of clarity and certainty for beneficiaries, as the property automatically transfers to them without the delays and costs typically associated with probate proceedings. Understanding the nuances of this deed can help individuals make informed decisions about their estate planning needs.

Common mistakes

Filling out a Transfer-on-Death (TOD) Deed form in Washington can seem straightforward, but many individuals make common mistakes that can lead to complications down the road. Understanding these pitfalls can save time, money, and stress. Here are nine mistakes to watch out for.

One frequent error is failing to include the correct legal description of the property. Instead of using vague terms, it’s crucial to provide the precise legal description as found in the property’s title. This ensures clarity and avoids potential disputes among heirs.

Another common mistake is neglecting to sign the deed in front of a notary. Washington law requires that the TOD Deed be notarized for it to be valid. Without this step, the document may not hold up in court, leaving your intentions unfulfilled.

Some individuals also forget to record the deed with the county auditor’s office. While filling out the form is essential, recording it is equally important. If not recorded, the deed may not be recognized, and the property could be subject to probate.

People often overlook the importance of naming a beneficiary. Leaving this section blank can lead to confusion and unintended consequences. It’s vital to clearly designate who will inherit the property upon the owner’s death.

Another mistake is not considering the implications of naming multiple beneficiaries. While it may seem like a good idea to divide the property among several people, this can lead to disagreements later. Clear communication and understanding among beneficiaries are essential to prevent conflict.

Additionally, individuals sometimes fail to update the deed after significant life changes, such as marriage, divorce, or the death of a beneficiary. Keeping the deed current is crucial to ensure that it reflects your wishes accurately.

Some may also forget to check the beneficiary’s eligibility. In Washington, certain individuals, such as minors or individuals with legal incapacity, may not be able to inherit property directly. It’s important to consider these factors when designating beneficiaries.

Another common oversight is using a TOD Deed for property types that are not eligible. For instance, some types of property, like certain types of personal property or assets held in trust, cannot be transferred via a TOD Deed. Understanding what can and cannot be included is vital.

Finally, many people fail to consult with a legal professional when filling out the form. While it might seem like an unnecessary step, getting expert advice can help navigate the complexities and ensure that all aspects of the deed are properly addressed.

Similar forms

- Last Will and Testament: A document that outlines how a person's assets should be distributed upon their death. Like a Transfer-on-Death Deed, it allows for the transfer of property but typically requires probate.

- Living Trust: This is a legal arrangement where assets are placed into a trust during a person's lifetime. Similar to a Transfer-on-Death Deed, it allows for the seamless transfer of property without going through probate.

- Beneficiary Designation Forms: Commonly used for financial accounts and insurance policies, these forms specify who will receive assets upon the owner's death. They operate similarly to a Transfer-on-Death Deed by directly transferring assets to designated beneficiaries.

- BBB Complaint Form: The BBB Complaint Form is a standardized document utilized by consumers to lodge complaints about businesses with the Better Business Bureau. This form serves as a critical tool for initiating the process of dispute resolution between consumers and companies. By providing a structured way to report issues, it plays an essential role in maintaining trust and accountability in the marketplace. For more information, you can refer to OnlineLawDocs.com.

- Joint Tenancy with Right of Survivorship: This ownership arrangement allows two or more people to own property together. When one owner dies, their share automatically passes to the surviving owner, similar to how a Transfer-on-Death Deed functions.

- Payable-on-Death Accounts: These bank accounts allow the account holder to designate a beneficiary who will receive the funds upon the account holder's death. This is akin to a Transfer-on-Death Deed in that it enables direct transfer of assets without probate.

- Community Property with Right of Survivorship: In some states, this form of property ownership allows spouses to own property together. Upon one spouse's death, the property automatically transfers to the surviving spouse, similar to the Transfer-on-Death Deed.

- Transfer-on-Death Registration for Securities: This allows individuals to designate a beneficiary for their stocks and bonds. Like a Transfer-on-Death Deed, it ensures that the assets transfer directly to the beneficiary without going through probate.

- Real Estate Transfer Form: This document facilitates the transfer of real estate ownership. While it may not have the same automatic transfer feature as a Transfer-on-Death Deed, it serves a similar purpose of transferring property ownership.

Some Other Washington Templates

Free Homeschooling in Washington State - This letter is your formal declaration of homeschooling intentions.

Washington State Rental Agreement - The document may stipulate the process for providing notice of issues or repairs.

For those looking to obtain their financial documentation, the Sample Tax Return Transcript form serves as a vital resource. It summarizes essential information about an individual's tax filing with the Internal Revenue Service, including aspects such as income and tax credits. This document can be especially important when navigating financial applications or verifying income details. To explore more about obtaining this transcript, you can visit https://topformsonline.com/sample-tax-return-transcript/.

Vehicle Bill of Sale Washington - A Trailer Bill of Sale is a document that records the sale of a trailer.