Attorney-Approved Washington Small Estate Affidavit Template

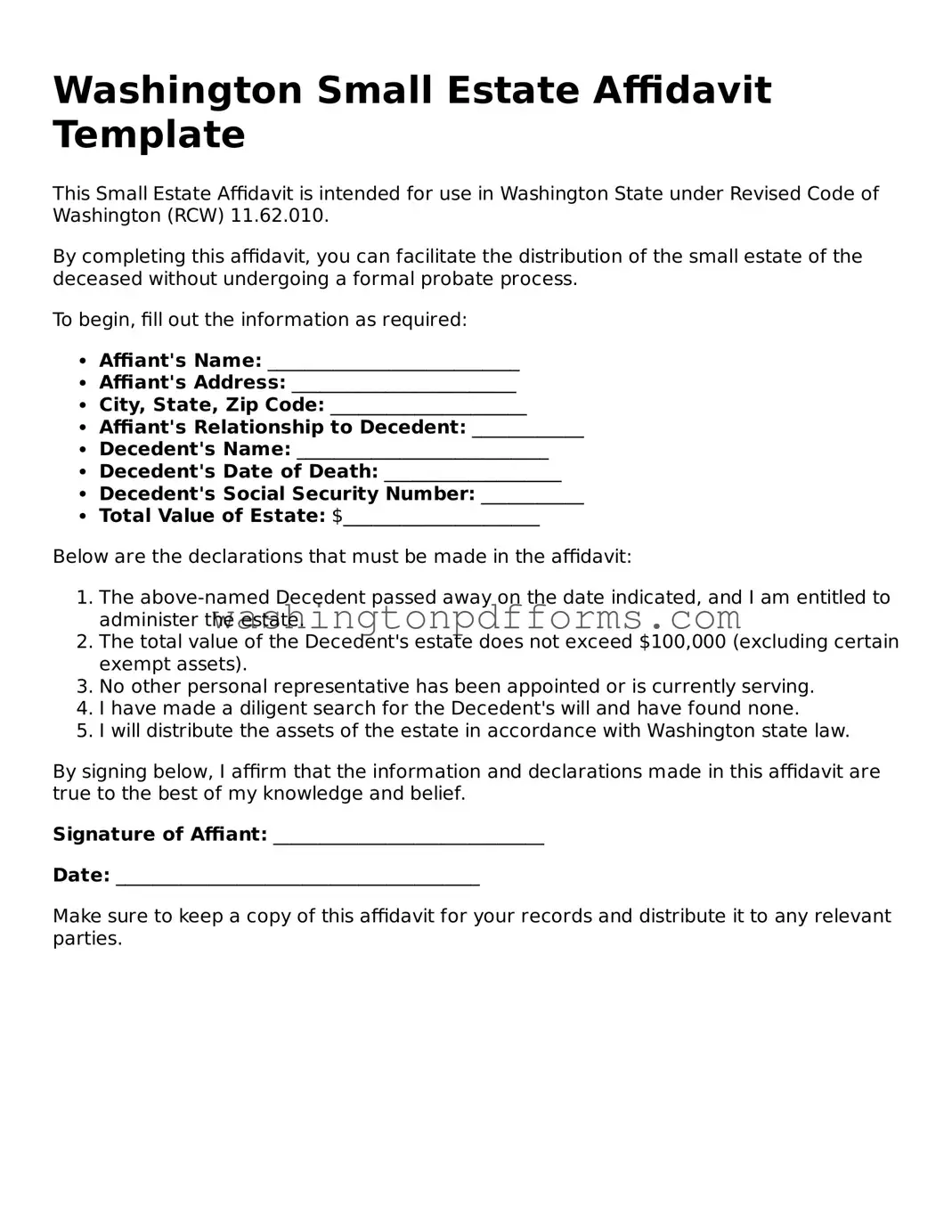

When a loved one passes away, managing their estate can often feel overwhelming, especially during a time of grief. In Washington State, the Small Estate Affidavit offers a streamlined process for individuals dealing with the estate of someone who has died, provided the estate meets certain criteria. This form allows heirs to claim assets without the need for formal probate, simplifying the transfer of property and funds. Typically, this option is available when the total value of the estate is below a specified threshold, which can change over time. The affidavit must be completed accurately and submitted to the appropriate financial institutions or agencies to access the deceased's assets. Additionally, the form requires the signature of the person claiming the assets, ensuring that the process remains straightforward and accessible. Understanding the requirements and implications of the Small Estate Affidavit can significantly ease the burden of settling an estate, making it an essential tool for many families in Washington.

Common mistakes

Filling out the Washington Small Estate Affidavit can be a straightforward process, but many individuals encounter common pitfalls. One frequent mistake is failing to accurately identify the deceased. It is crucial to provide the full name and date of death. Incomplete or incorrect information can lead to delays or even rejection of the affidavit.

Another common error involves not including all the required assets. The affidavit must list all property belonging to the deceased that is valued under the state’s threshold. Omitting even a single asset can complicate the process, potentially resulting in legal complications later on.

People often overlook the importance of signatures. The affidavit requires the signatures of all heirs or beneficiaries. If one person neglects to sign, it may invalidate the entire document. Ensuring that everyone involved has reviewed and signed the affidavit is essential for its acceptance.

Additionally, individuals sometimes misjudge the timing of the affidavit's submission. Filing too early or too late can create issues. The affidavit should be submitted after the death but before any significant assets are transferred. Understanding this timeline is key to a smooth process.

Another mistake is failing to provide proper identification. When submitting the affidavit, individuals must include valid identification for themselves and any other signatories. Without this, the affidavit may be rejected by the court or financial institutions.

Moreover, many people forget to check for updates to the form or the laws surrounding it. Legal requirements can change, and using an outdated form can lead to problems. Always ensure you are using the most current version of the Small Estate Affidavit.

Some individuals also underestimate the importance of notarization. While not always required, having the affidavit notarized can lend credibility and help avoid disputes. A notarized document is often taken more seriously by banks and other entities.

Finally, a lack of clarity in the affidavit can lead to confusion. Using vague language or failing to clearly describe the assets can create misunderstandings. Clear, precise language helps ensure that all parties understand the contents of the affidavit and reduces the risk of disputes.

Similar forms

- Will: A will outlines how a person's assets should be distributed after their death. Like a Small Estate Affidavit, it serves to transfer ownership but requires probate, while the affidavit simplifies the process for smaller estates.

- BBB Complaint Form - This form allows consumers to file grievances against businesses, ensuring their issues are communicated effectively. For more information, visit TopTemplates.info.

- Probate Petition: This document initiates the probate process to validate a will. The Small Estate Affidavit can often bypass this lengthy process for estates below a certain value.

- Letters Testamentary: Issued by a court, these letters give an executor the authority to act on behalf of the estate. The Small Estate Affidavit allows heirs to act without needing such formal appointment.

- Trust Document: A trust manages assets during a person's life and after death. Both documents facilitate asset transfer but in different contexts, with trusts often avoiding probate altogether.

- Affidavit of Heirship: This document establishes who the heirs are when someone dies without a will. The Small Estate Affidavit similarly confirms heirs and allows for asset transfer without probate.

- Release of Claim: This document allows a party to relinquish any claims to an estate. The Small Estate Affidavit can help clarify who is entitled to what, streamlining the process.

- Asset Distribution Agreement: This agreement outlines how assets will be divided among heirs. The Small Estate Affidavit serves a similar purpose by providing a straightforward way to distribute assets without court intervention.

Some Other Washington Templates

Release and Hold Harmless Agreement - It outlines the responsibilities and protections between parties involved in an agreement.

Wa Vehicle Bill of Sale - Includes space for signatures, solidifying the agreement reached.

To facilitate a smooth rental process, it’s important to understand the standard Room Rental Agreement requirements that protect both landlords and tenants. This document delineates crucial terms, ensuring that all parties are aware of their obligations and rights during the leasing period.

Lease Agreement Washington State - May establish guidelines for yard or garden maintenance.