Attorney-Approved Washington Rental Application Template

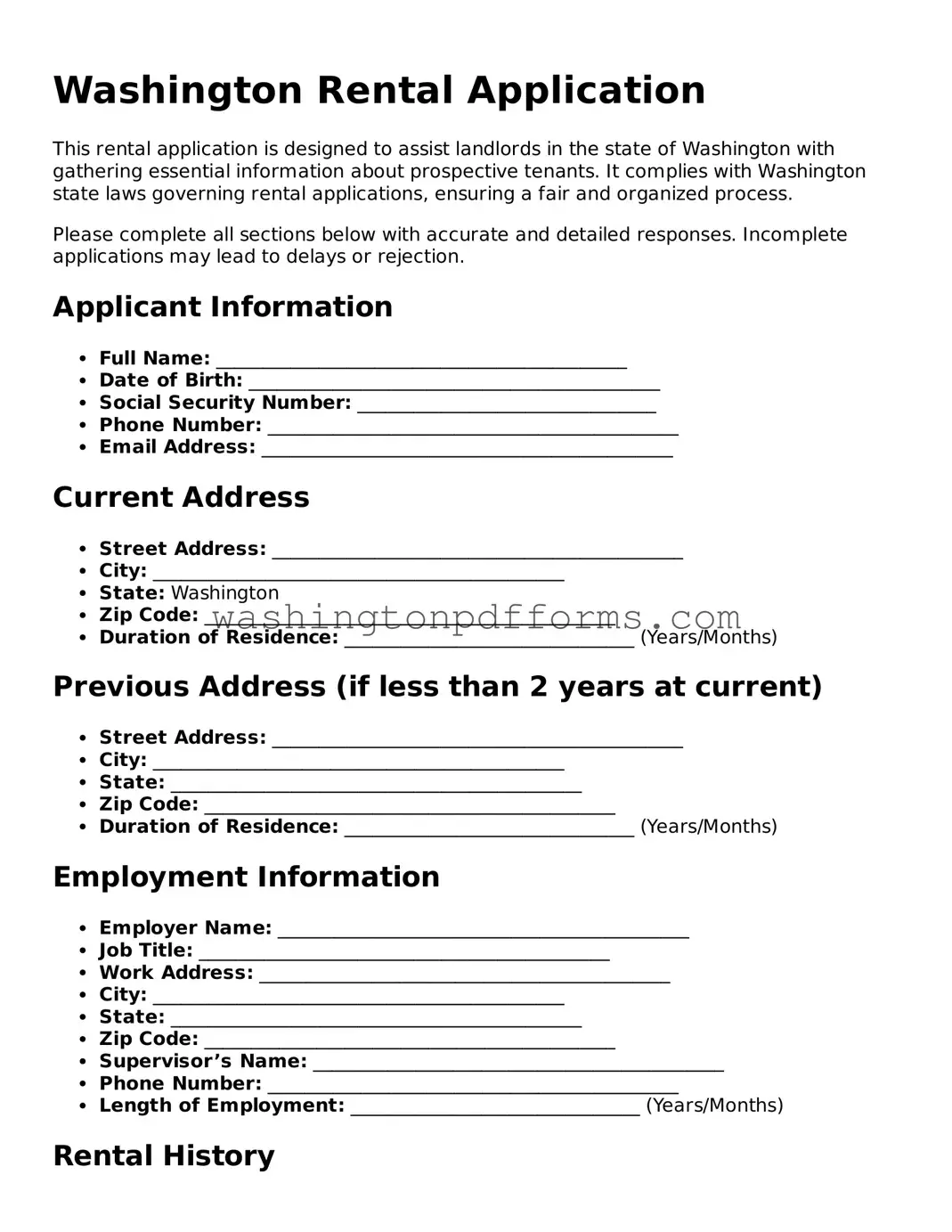

The Washington Rental Application form is a crucial document for both landlords and prospective tenants. This form collects essential information that helps landlords assess the suitability of applicants for rental properties. Key components typically include personal details such as name, contact information, and social security number. Additionally, applicants provide information about their rental history, employment status, and income to demonstrate financial stability. The form often requires references, allowing landlords to verify the applicant's background. Furthermore, applicants may need to consent to a credit check, which helps landlords evaluate their financial responsibility. Understanding the requirements and implications of this form is vital for anyone navigating the rental market in Washington.

Common mistakes

Filling out a rental application in Washington can be a straightforward process, but many applicants make common mistakes that can hinder their chances of securing a rental. One frequent error is leaving sections of the application blank. Each part of the form is designed to gather important information. Omitting details can raise red flags for landlords and property managers.

Another mistake is providing inaccurate information. This can include incorrect phone numbers, misspelled names, or wrong employment details. Landlords often verify the information provided, and discrepancies can lead to disqualification. It is essential to double-check all entries for accuracy before submitting the application.

Many applicants also fail to disclose their rental history completely. Landlords typically look for a comprehensive rental history, including previous addresses and landlord contact information. Incomplete histories can lead to questions about reliability and trustworthiness.

Some individuals neglect to include necessary documentation, such as proof of income or identification. Most landlords require these documents to assess the applicant's financial stability. Without them, the application may be considered incomplete and could be rejected.

Providing insufficient references is another common mistake. Applicants should aim to include a mix of personal and professional references. Landlords appreciate hearing from individuals who can vouch for the applicant’s character and reliability.

Additionally, some applicants overlook the importance of their credit history. A poor credit score can significantly impact the application process. It is advisable to check credit reports beforehand and address any issues that may arise.

Misunderstanding the application fee is also a frequent error. Some applicants are surprised by the non-refundable nature of these fees. It is crucial to be aware of the costs involved and ensure that payment is submitted promptly to avoid delays.

Another mistake is failing to follow up after submission. A proactive approach can demonstrate interest and professionalism. Applicants should consider reaching out to the landlord or property manager to inquire about the status of their application.

Lastly, neglecting to read the fine print can lead to misunderstandings. Each rental application may have specific terms and conditions. Understanding these details can prevent future disputes and ensure a smoother rental process.

Similar forms

-

Lease Agreement: This document outlines the terms and conditions of renting a property. Similar to a rental application, it requires personal information and details about rental history, but it is legally binding once signed.

-

Background Check Authorization: This form allows landlords to conduct a background check on potential tenants. Like the rental application, it collects personal information and consent for checking criminal and credit history.

-

Employment Verification Form: Used to confirm a tenant's employment status and income, this document is similar in that it seeks financial information to assess a tenant's ability to pay rent.

-

Credit Application: This document is used by landlords to evaluate a tenant's creditworthiness. It shares similarities with the rental application in that it gathers financial history and personal details.

-

Pet Application: If a tenant wishes to have pets in a rental unit, this form collects information about the pet. It parallels the rental application by requesting personal details and may include references.

-

Move-In Checklist: This document outlines the condition of the property before a tenant moves in. While it focuses on property details, it is often completed alongside the rental application process.

Articles of Incorporation: For those starting a corporation, our essential guide to Articles of Incorporation outlines the necessary steps and required information.

-

Rental Reference Form: This form is used to gather references from previous landlords or personal contacts. Similar to a rental application, it helps landlords assess a tenant’s reliability.

-

Income Verification Document: This document confirms a tenant's income through pay stubs or tax returns. Like the rental application, it is crucial for determining financial stability.

Some Other Washington Templates

Odometer Disclosure Statement Washington - This document is beneficial for individuals who are incapacitated or otherwise unable to manage their vehicle affairs.

When submitting a complaint, you can utilize the BBB Complaint Form to ensure your concerns are addressed effectively. For more detailed guidance on how to navigate the process and maximize your chances of a successful resolution, visit TopTemplates.info, a valuable resource for consumers seeking assistance with their complaints.

Release and Hold Harmless Agreement - It encourages responsible behavior by acknowledging potential hazards.