Attorney-Approved Washington Quitclaim Deed Template

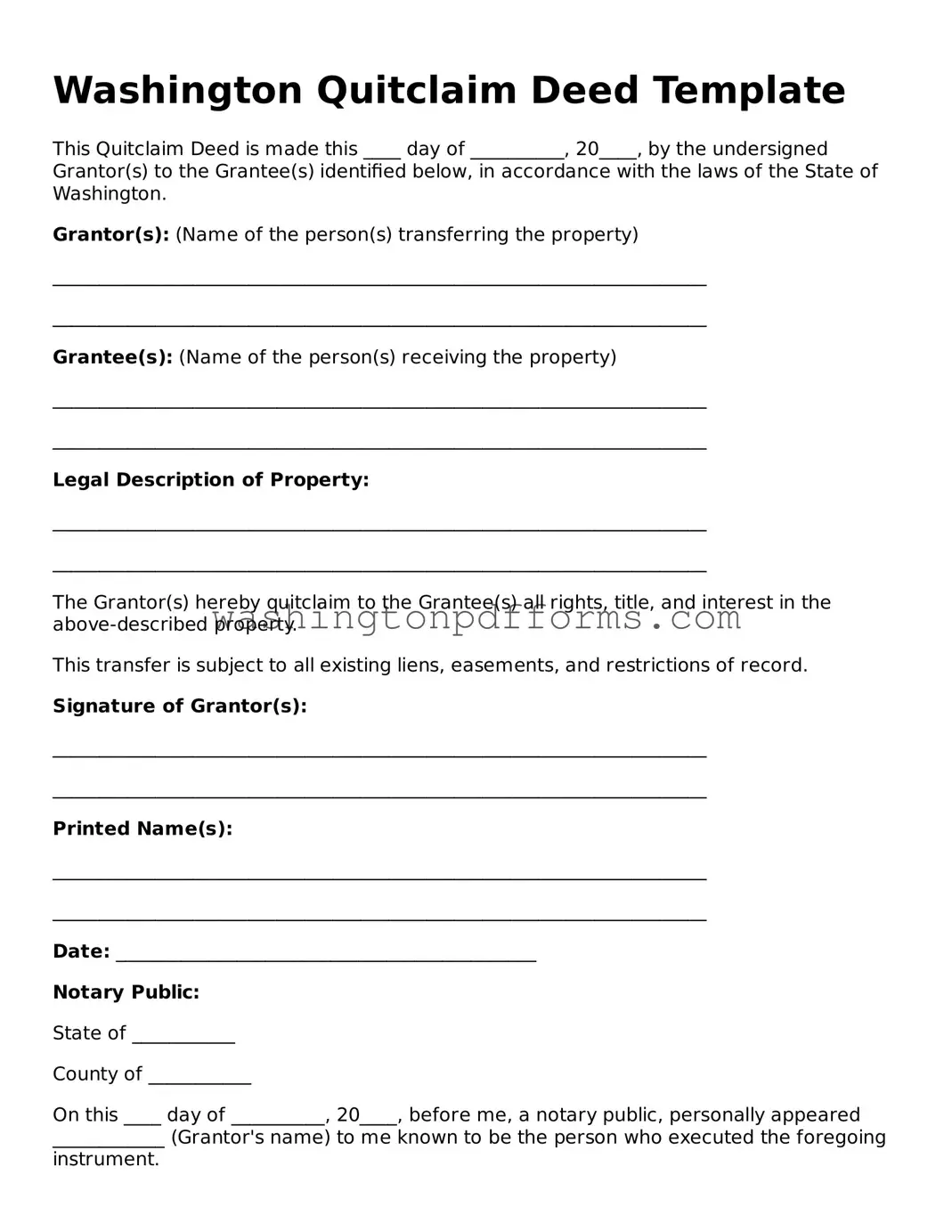

In Washington State, the Quitclaim Deed form serves as a straightforward tool for transferring property ownership. This legal document allows one party, known as the grantor, to convey their interest in a property to another party, the grantee, without making any guarantees about the title's validity. Unlike other types of deeds, a quitclaim deed does not require the grantor to provide a warranty or assurance that the property is free from liens or encumbrances. This makes it particularly useful in situations such as transferring property between family members, clearing up title issues, or during divorce settlements. The form must be properly filled out, signed, and notarized to be legally effective. Additionally, it is essential to record the quitclaim deed with the county auditor to ensure public notice of the change in ownership. Understanding these aspects is crucial for anyone looking to navigate property transfers in Washington effectively.

Common mistakes

When filling out the Washington Quitclaim Deed form, many individuals make common mistakes that can lead to significant issues down the line. One frequent error is failing to include the correct legal description of the property. This description should be precise and detailed, as it identifies the property being transferred. Without it, the deed may not be valid, leaving both parties in a precarious situation.

Another mistake often seen is neglecting to include the names of all parties involved. Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly stated. Omitting a name can cause confusion and complicate the transfer process, potentially leading to disputes.

Many individuals also overlook the requirement for notarization. A Quitclaim Deed must be signed in front of a notary public to be legally binding. Skipping this step can invalidate the deed, making it crucial to ensure that all signatures are properly notarized before submission.

Inaccurate or incomplete information regarding the property's tax parcel number is another common issue. This number is essential for identifying the property in county records. Failing to provide it or entering it incorrectly can result in delays or complications in the recording process.

Some people forget to check for existing liens or encumbrances on the property. A Quitclaim Deed does not guarantee that the property is free of debts. If there are outstanding obligations, the new owner may find themselves responsible for those debts, leading to unexpected financial burdens.

Another mistake is not including the date of transfer. While it may seem minor, the date is crucial for establishing the timeline of ownership. This can affect future transactions and the legal standing of the deed.

Individuals sometimes fail to provide a clear statement of consideration. This refers to the value exchanged for the property, even if it is a nominal amount. Leaving this blank can create ambiguity and may raise questions during the recording process.

Additionally, people may not realize the importance of reviewing local recording requirements. Each county in Washington may have specific rules regarding the submission of a Quitclaim Deed. Not adhering to these requirements can lead to rejection of the deed.

Lastly, some individuals neglect to keep copies of the completed deed. Retaining a copy is essential for personal records and may be necessary for future reference. Without it, tracking ownership can become complicated, especially if disputes arise.

Similar forms

The Quitclaim Deed is a unique legal document used primarily to transfer ownership of property. However, it shares similarities with several other documents in real estate and property law. Here are nine documents that are similar to the Quitclaim Deed, along with a brief explanation of each:

- Warranty Deed: This document guarantees that the grantor has clear title to the property and provides protection to the grantee against any future claims. Unlike a Quitclaim Deed, it offers assurances regarding ownership.

- Grant Deed: Similar to a Warranty Deed, a Grant Deed conveys property and includes implied warranties about the title. It assures the grantee that the property has not been sold to anyone else.

- Special Purpose Deed: This type of deed is used for specific purposes, such as transferring property in a divorce or to a trust. It may share characteristics with a Quitclaim Deed in that it can transfer ownership without extensive guarantees.

- Deed of Trust: Used primarily in real estate financing, this document secures a loan with the property as collateral. It is similar to a Quitclaim Deed in that it involves the transfer of an interest in property, but it does not convey ownership outright.

- Lease Agreement: While not a deed, a lease agreement allows one party to use property owned by another for a specified time. Both documents involve rights to property, though a lease does not transfer ownership.

- Life Estate Deed: This deed grants someone the right to use a property during their lifetime, after which the property passes to another party. Like a Quitclaim Deed, it can transfer interests in property but with specific limitations on ownership.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased property owner. It can facilitate the transfer of property, similar to a Quitclaim Deed, but focuses on the legal recognition of heirs rather than a direct transfer of title.

- Power of Attorney: This legal document allows one person to act on behalf of another in property transactions. While it does not transfer ownership directly, it can enable a Quitclaim Deed to be executed by someone authorized to do so.

- Bill of Sale: This document transfers ownership of personal property rather than real estate. It shares the fundamental purpose of transferring ownership, similar to a Quitclaim Deed, but applies to movable items instead of immovable property.

Some Other Washington Templates

Notary Individual Acknowledgement Form - Signatories must personally appear before the notary to execute the acknowledgment.

Financial Power of Attorney Washington State - Having this document can reduce stress for your family during a difficult time.

How to Make a Nda Legal - This agreement ensures that sensitive data remains private and secure.