Attorney-Approved Washington Promissory Note Template

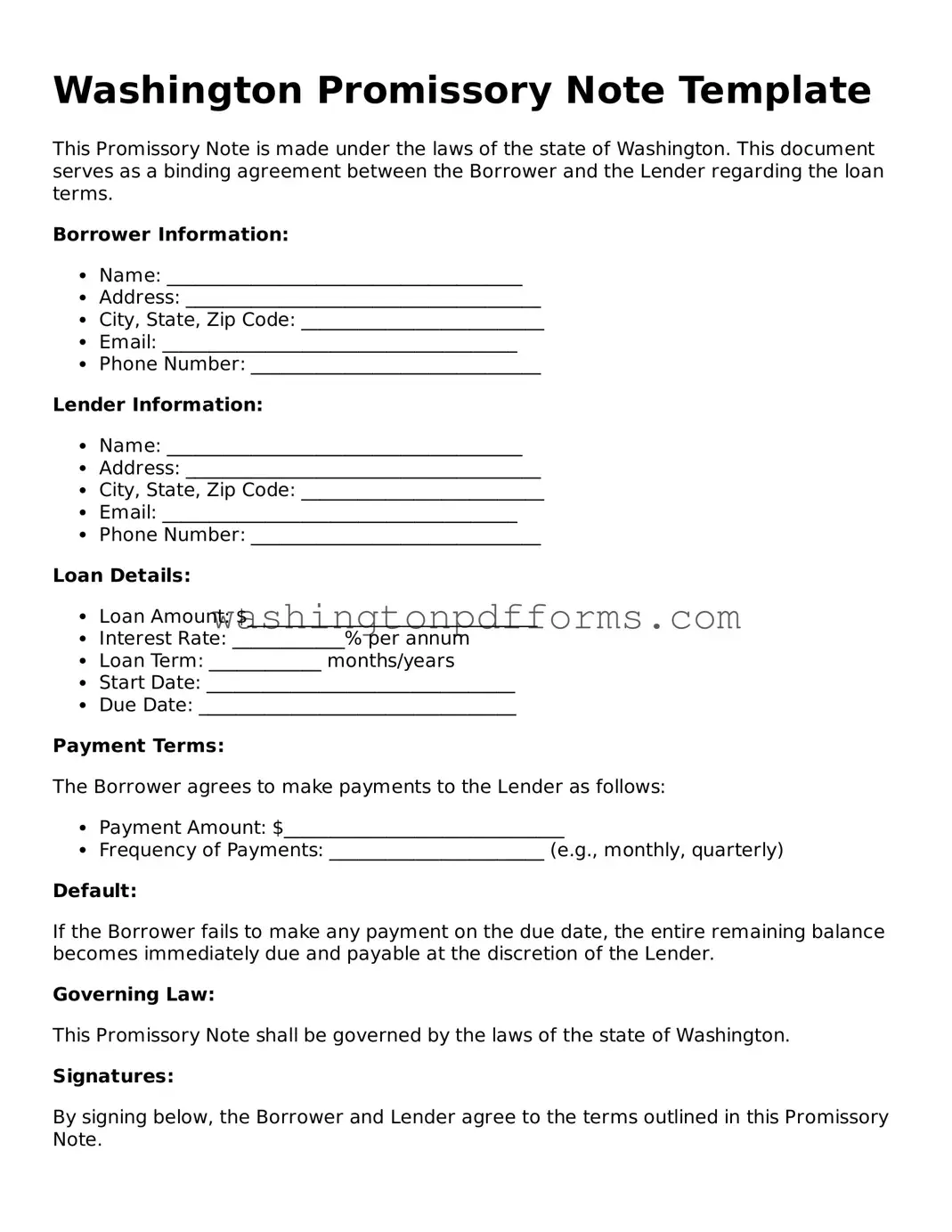

The Washington Promissory Note is a vital financial document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This form serves as a legally binding agreement, detailing essential elements such as the principal amount, interest rate, repayment schedule, and any applicable late fees. It is important to note that the Washington Promissory Note can be customized to suit the needs of both parties, allowing for flexibility in payment terms and conditions. Additionally, this form includes provisions for default, which protect the lender's rights in case the borrower fails to meet their obligations. By clearly defining the expectations and responsibilities of each party, the Washington Promissory Note fosters transparency and trust in financial transactions. Whether used for personal loans, business financing, or real estate transactions, this document plays a crucial role in ensuring that both borrowers and lenders are on the same page regarding their financial commitments.

Common mistakes

Filling out a Washington Promissory Note can seem straightforward, but there are common mistakes that can lead to complications down the line. One frequent error occurs when individuals forget to include the date. This small detail is crucial, as it establishes when the agreement takes effect. Without a date, it can create confusion regarding the timeline for repayment.

Another common mistake is failing to clearly identify the parties involved. It is essential to provide full names and addresses for both the borrower and the lender. Omitting this information can lead to disputes about who is responsible for repayment and who is entitled to receive payments.

People often overlook the importance of specifying the loan amount. Some may write the amount in words but forget to include the numerical figure, or vice versa. This inconsistency can create ambiguity, which might complicate enforcement of the note if repayment issues arise.

Additionally, many individuals neglect to outline the repayment terms clearly. This includes the interest rate, payment schedule, and any penalties for late payments. If these terms are vague or missing, it can lead to misunderstandings about what is expected from both parties.

Another mistake is not having the document properly signed. Both parties must sign the Promissory Note for it to be legally binding. Failing to do so can render the agreement unenforceable, leaving the lender without recourse if the borrower defaults.

Finally, some people forget to keep a copy of the signed Promissory Note. It is vital for both parties to retain a copy for their records. Without documentation, it can be challenging to prove the terms of the agreement in case of a dispute. Keeping a copy ensures that both parties have access to the same information and can refer back to it as needed.

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of borrowing and repayment. Both documents specify the loan amount, interest rate, and repayment schedule.

- Mortgage: A mortgage is a specific type of promissory note secured by real estate. It includes the terms of the loan and the property used as collateral.

- Credit Agreement: This document details the terms under which credit is extended. Like a promissory note, it includes repayment terms and conditions for default.

- Installment Agreement: An installment agreement outlines a repayment plan for a debt. It shares similarities with a promissory note in that it specifies payment amounts and due dates.

- Loan Application: While not a binding agreement, a loan application provides information about the borrower and the requested loan. It sets the stage for a promissory note by detailing the borrower's financial situation.

- Security Agreement: This document establishes collateral for a loan. It is often used alongside a promissory note, ensuring that the lender has a claim to specific assets in case of default.

- Debt Settlement Agreement: This agreement outlines the terms for settling a debt for less than the full amount owed. It is similar to a promissory note in that it requires the borrower to agree to specific payment terms.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a debt if the primary borrower defaults. It functions similarly to a promissory note by creating a legal obligation to repay.

- Cease and Desist Letter: When addressing potentially harmful actions, consider utilizing the effective Cease and Desist Letter form to formally demand a halt to such activities.

- Forbearance Agreement: This document allows a borrower to temporarily pause payments. It often includes terms for how missed payments will be handled, similar to a promissory note's repayment terms.

Some Other Washington Templates

Equine Bill of Sale Pdf - Documentation can offer peace of mind for both parties involved.

The process of applying for real estate licenses in California requires careful attention to documentation, including the completion of the California Re 205 form, which is essential for declaring your citizenship or immigration status to ensure compliance with state regulations regarding public benefits.

Separation Agreement Washington State - A guide to navigating joint accounts during separation.