Attorney-Approved Washington Prenuptial Agreement Template

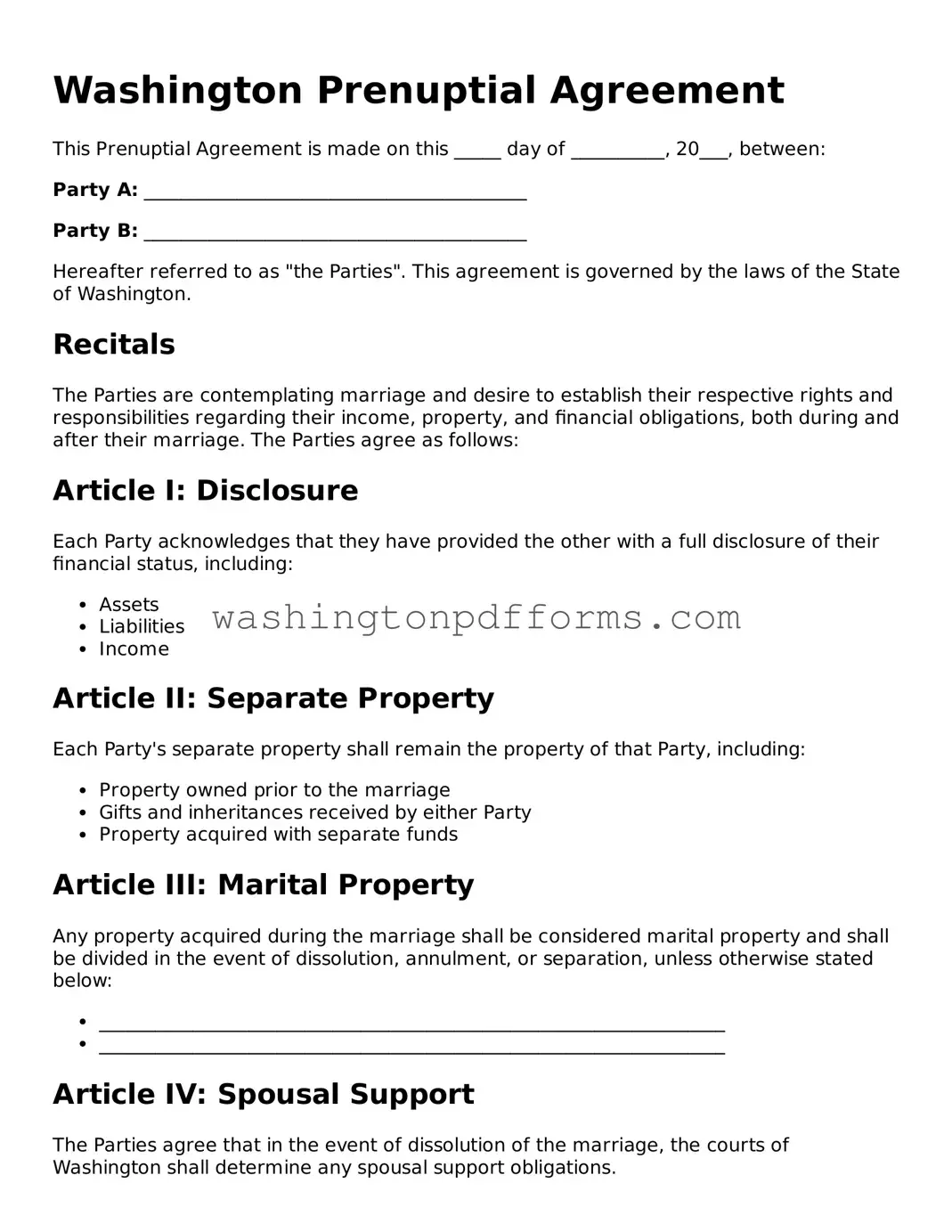

When considering marriage, many couples in Washington may want to take a proactive approach to their financial future by drafting a prenuptial agreement. This legal document serves as a safeguard, outlining how assets and debts will be handled in the event of a divorce or separation. A well-structured Washington Prenuptial Agreement addresses various essential aspects, including the identification of separate and marital property, provisions for spousal support, and the division of assets acquired during the marriage. Couples can also include terms related to debt management, ensuring that both parties understand their financial responsibilities. Importantly, the agreement must be fair and entered into voluntarily by both parties, and it should be signed well in advance of the wedding to avoid any claims of coercion. By taking these steps, couples can foster open communication about finances and lay a solid foundation for their marriage, ultimately reducing potential conflicts down the line.

Common mistakes

Completing a prenuptial agreement in Washington can be a crucial step for couples entering marriage. However, several common mistakes can lead to complications or disputes later on. Understanding these pitfalls can help ensure that the agreement is valid and serves its intended purpose.

One frequent error is the failure to fully disclose all assets and debts. Both parties must provide a complete and honest account of their financial situations. Omitting significant assets or liabilities can render the agreement unenforceable. Transparency is essential for the agreement to be fair and valid.

Another mistake involves not considering the legal requirements for the document. In Washington, a prenuptial agreement must be in writing and signed by both parties. Verbal agreements or informal arrangements do not hold up in court. Ensuring that the agreement is properly documented is vital to its effectiveness.

Additionally, individuals sometimes overlook the importance of having independent legal counsel. Each party should ideally consult their own attorney before signing the agreement. This step helps ensure that both parties understand their rights and obligations. Without legal guidance, one party may inadvertently agree to terms that are not in their best interest.

Timing can also be an issue. Couples should avoid waiting until the last minute to draft and sign the agreement. Rushing through the process can lead to mistakes or misunderstandings. It is advisable to start discussions well in advance of the wedding date, allowing ample time for negotiation and revision.

Lastly, failing to review and update the agreement over time is a common oversight. Life circumstances change, and what was once an appropriate agreement may no longer reflect the couple's current situation. Regularly revisiting the prenuptial agreement can help ensure it remains relevant and fair.

Similar forms

A Prenuptial Agreement is a legal document that outlines the financial and personal arrangements between two individuals before they marry. Several other documents serve similar purposes in various contexts. Here are eight documents that share similarities with a Prenuptial Agreement:

- Postnuptial Agreement: This document is created after marriage, detailing how assets and debts will be managed during the marriage and in the event of divorce. Like a prenuptial agreement, it aims to clarify financial expectations.

- Separation Agreement: When couples decide to live apart, this document outlines the terms of their separation, including asset division and child custody. It serves a similar purpose to a prenuptial agreement in terms of financial clarity.

General Power of Attorney Form: This document grants authority to someone to manage financial and legal decisions on your behalf. For guidance, refer to the relevant General Power of Attorney resources that outline its use and significance.

- Divorce Settlement Agreement: This is a formal agreement reached during divorce proceedings that specifies how property and debts will be divided. It resembles a prenuptial agreement in its focus on asset distribution.

- Co-habitation Agreement: For couples living together without marriage, this document outlines the rights and responsibilities of each partner regarding property and finances, akin to a prenuptial agreement.

- Will: A will specifies how a person's assets will be distributed after their death. While not directly related to marriage, it shares the goal of clarifying financial matters for loved ones.

- Trust Agreement: This document establishes a trust to manage assets for beneficiaries. It can be similar to a prenuptial agreement in that it protects assets and specifies how they should be handled.

- Business Partnership Agreement: This outlines the terms of a business partnership, including profit sharing and responsibilities. Like a prenuptial agreement, it sets expectations and protects interests.

- Financial Power of Attorney: This document grants someone authority to make financial decisions on behalf of another. It can be similar in its focus on managing financial affairs, though it typically applies in different circumstances.

Some Other Washington Templates

Washington Last Will and Testament - Your will can reflect your values by supporting causes you care about after you’re gone.

For those looking to secure their living arrangements, the Room Rental Agreement form is a vital tool that ensures both parties understand their obligations, thereby fostering a smooth rental experience.

Farm Tractor Bill of Sale - The document may include a section for additional agreements.

Health Care Directive Washington State - Creating a Living Will ensures that your healthcare choices are honored when you're unable to voice them.