Attorney-Approved Washington Durable Power of Attorney Template

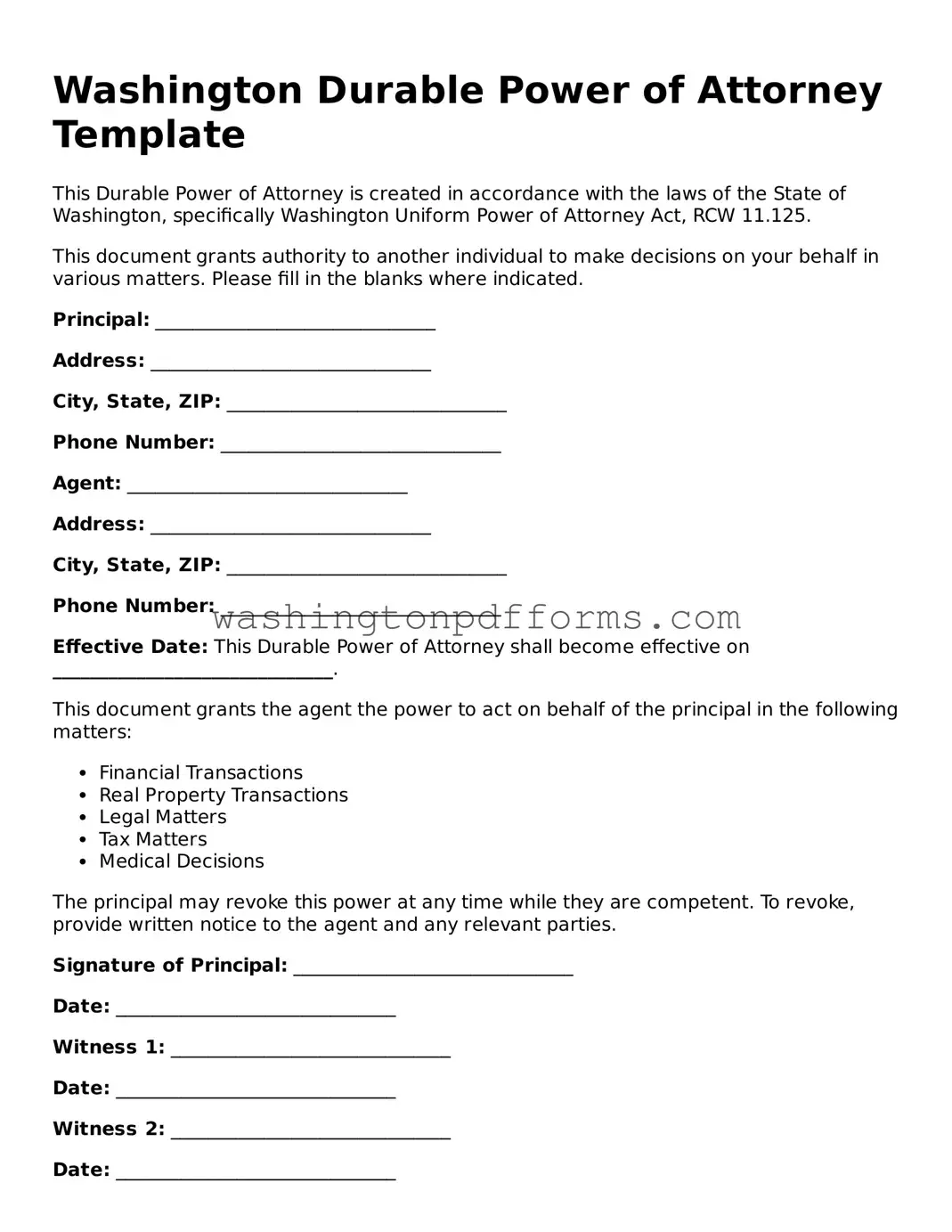

The Washington Durable Power of Attorney form is an essential legal document that allows individuals to appoint someone they trust to make decisions on their behalf in case they become unable to do so. This form is particularly important for managing financial matters, healthcare decisions, and other personal affairs. In Washington, the durable power of attorney remains effective even if the principal becomes incapacitated, which sets it apart from other types of power of attorney. The appointed individual, known as the agent or attorney-in-fact, gains the authority to handle a wide range of responsibilities, including managing bank accounts, paying bills, and making medical decisions. It is crucial for the principal to choose a trustworthy agent, as this person will have significant control over their affairs. Additionally, the form must be properly completed, signed, and witnessed to ensure its validity. Understanding the major aspects of this document can help individuals make informed decisions about their future and ensure their wishes are respected during times of need.

Common mistakes

When filling out the Washington Durable Power of Attorney form, many people make common mistakes that can lead to complications down the line. One frequent error is failing to clearly identify the agent. It’s essential to specify who will act on your behalf. If the agent’s name is unclear or missing, it can cause confusion and delay in decision-making.

Another mistake is not signing the document properly. The principal must sign the form in the presence of a notary public. If the signature is missing or improperly witnessed, the document may not hold up in court. Always ensure that the signature is executed correctly to avoid future disputes.

Some individuals overlook the importance of including specific powers granted to the agent. Without detailing the powers, the agent may not have the authority to make critical decisions. Clearly outline what your agent can and cannot do to prevent misunderstandings.

Additionally, people often forget to date the document. A Durable Power of Attorney should include a date to establish when the powers take effect. Without a date, it may be difficult to determine the validity of the document, especially if there are changes in circumstances.

In some cases, individuals fail to consider alternate agents. Life is unpredictable, and your chosen agent may not always be available. Designating an alternate ensures that there is someone ready to step in if needed, providing peace of mind.

Another common error involves not reviewing the form after completion. It’s crucial to double-check for any mistakes or omissions. A simple oversight can lead to significant issues later. Take the time to review the document thoroughly.

People also sometimes neglect to communicate their intentions with their agent. A Durable Power of Attorney is not just a legal document; it’s a tool for ensuring your wishes are respected. Discussing your decisions with your agent can help them understand your preferences and act accordingly.

Lastly, failing to keep the document updated is a mistake that can have serious consequences. Life changes, such as marriage, divorce, or the birth of children, may necessitate updates to your Durable Power of Attorney. Regularly review and revise the document to ensure it reflects your current wishes.

Similar forms

- General Power of Attorney: Like the Durable Power of Attorney, this document allows someone to act on your behalf. However, it becomes invalid if you become incapacitated, unlike the durable version which remains effective.

- Healthcare Power of Attorney: This document specifically gives someone the authority to make medical decisions for you if you're unable to do so. It focuses on healthcare choices, while the durable power covers broader financial and legal matters.

- Living Will: A Living Will outlines your wishes regarding medical treatment at the end of life. While it doesn’t appoint someone to make decisions, it complements a Healthcare Power of Attorney by clarifying your preferences.

- Will: A Will distributes your assets after death and appoints guardians for minors. Unlike a Durable Power of Attorney, which is effective during your lifetime, a Will only takes effect after your passing.

- Trust: A Trust allows you to manage your assets during your lifetime and beyond. Similar to a Durable Power of Attorney, it can help avoid probate, but it requires a more complex setup and management.

- Advance Directive: This document combines a Living Will and a Healthcare Power of Attorney. It expresses your wishes regarding medical care and designates someone to make decisions, ensuring your preferences are honored.

- Financial Power of Attorney: This is similar to a Durable Power of Attorney but may have limitations. It typically focuses on financial matters, while the durable version can cover a wider range of responsibilities.

Some Other Washington Templates

Selling a Vehicle in Washington State - Contains fields for both buyer and seller signatures to validate the transaction.

Washington Lease Agreement Pdf - The document may specify pet policies and restrictions on animals in the rental unit.

Non Compete Washington - Employees should consult legal professionals to understand their rights fully.